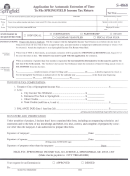

Form Nyc-Ext - Application For Automatic Extension Of Time To File Business Income Tax Returns - 2017 Page 4

ADVERTISEMENT

Form NYC-EXT - 2017

Page 4

Short periods - fixed dollar minimum tax. Com-

E L E C T R O N I C F I L I N G

pute the New York City receipts for short periods

(tax periods of less than 12 months) by dividing

the amount of New York receipts by the number of

Register for electronic filing. eServices is an

months in the short period and multiplying the re-

easy, secure and convenient way to file an ex-

sult by 12. The fixed dollar minimum tax may be

tension and pay tax on-line.

reduced for short periods:

For more information log on to:

Period Reduction

NYC.gov/eservices

l Not more than 6 months......................... 50%

l More than 6 months

but not more than 9 months.................... 25%

M A I L I N G I N S T R U C T I O N S

l More than 9 months...............................None

Line 2

Make remittance payable to the order of:

First Installment of Subsequent Year’s Estimated

NYC DEPARTMENT OF FINANCE

Tax for S corporation tax only.

Payment must be made in U.S.dollars, drawn

on a U.S. bank.

Not applicable to those requesting an extension to

file a final return.

To receive proper credit, you must enter your

S corporations only

correct Employer Identification Number or So-

If the estimated tax shown on line 1 exceeds

cial Security Number on your application and

$1,000, you must pay the amount shown on line 2

remittance.

as the first installment payment of estimated tax

for the calendar year or fiscal year following the

tax year covered by this application. The amount

shown on line 2, if properly computed, is your re-

quired first installment of estimated tax for the fol-

M A I L A P P L I C AT I O N S T O :

lowing year, and cannot be changed when filing

your completed tax return.

NYC DEPARTMENT OF FINANCE

When to File

P.O. BOX 3653

This application must be filed no later than 2 1/2

months after the year end for the S corporations

NEW YORK, NY 10008-3653

and UBT - Partnerships or 3 1/2 months after the

year end for C corporations and UBT - Individu-

als. Corporate taxpayers requesting an extension

to file a final return, see paragraph #3 under “Gen-

eral Information”.

CAUTION

An extension of time to file your federal tax return

or New York State Franchise Tax return does NOT

extend the filing date of your New York City tax re-

turn.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4