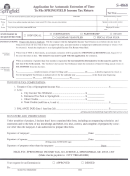

Form Nyc-Ext - Application For Automatic Extension Of Time To File Business Income Tax Returns - 2017 Page 2

ADVERTISEMENT

Form NYC-EXT - 2017

Page 2

I N S T R U C T I O N S

Legislative Changes

turn or apply for an extension of time to file a

final return on or before the 15th day after the

date that the corporation ceases to be subject to

The Corporation Tax, as used in these instruc-

the Corporation Tax.

tions, refers to the Business Corporation Tax under

4. A properly estimated tax must be either:

Subchapter 3-A, General Corporation Tax under

Subchapter 2 and Banking Corporation Tax under

a) not less than 90% of the tax for the year for

Part 4 of Subchapter 3 of Chapter 6 of Title 11 of

the NYC Administrative Code.

which an extension is requested as finally de-

termined

- or -

See the instructions to Forms NYC-2, NYC-2A,

b) not less than the tax shown on the return for

NYC-3L, NYC-3A, NYC-4S, NYC-4S-EZ, NYC-1

and NYC-1A for legislative changes affecting the

the preceding taxable year if that year con-

calculation of the Corporation Tax.

sisted of 12 months for S corporations or the

second preceding year for C corporations.

See the instructions to Forms NYC-202, NYC-

NOTE: For this purpose, the tax as finally de-

202EIN and NYC-204 for legislative changes af-

fecting the calculation of the Unincorporated

termined includes a final determination of the

Business Tax (UBT).

tax due for the taxable period after an audit, the

filing of an amended return or any other adjust-

General Information

ment or correction.

1. If you file this application on or before the due

For UBT partnership filers, if the partnership had

date, you will automatically receive an exten-

$1,000,000 or more of unincorporated business

sion of six months after the due date for the fil-

taxable income allocated to the City for any tax-

ing of your completed tax return, if you properly

able year during the three years immediately

estimate the tax and send a remittance in the

preceding the taxable year covered by this ap-

amount shown on line 5. (If line 4 exceeds line

plication, a properly estimated tax is not less

3, no remittance is required.)

than 90% of the tax as it is finally determined.

Clause (b) above is not applicable.

2. A corporate taxpayer that has received an auto-

matic six-month extension by filing this form may

Finance will not grant an extension to a tax-

request up to two additional three-month exten-

payer that fails to meet all of these require-

sions by filing NYC-EXT.1. A separate form

ments. If the tax return for which the extension

NYC-EXT.1 must be filed for each additional

was requested is filed after the due date, the

three-month extension requested. The Depart-

Department may assess late charges and in-

ment of Finance may grant one or both additional

terest. If the taxpayer has obtained a valid au-

three-month extensions if good cause exists.

tomatic extension, only interest will be charged

on any balance due with the return.

A UBT taxpayer may not request an additional

Line 1

extension.

On line 1, enter the estimated tax, after allowable

3. If a corporation ceases to be subject to tax

credits for the year covered by this application.

under the Corporation Tax, the tax accounting

See paragraph 3 under “General Information”.

period ends on the date on which the cessation

Combined Filers

occurs and is the corporation’s taxable year for

that period. The corporation must file a final re-

The combined filing is subject to revision or disal-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4