Form Nyc-Ext - Application For Automatic Extension Of Time To File Business Income Tax Returns - 2017 Page 3

ADVERTISEMENT

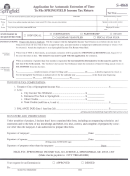

Form NYC-EXT - 2017

Page 3

lowance on audit. The combined group should file a

sidiary, except if there is only one subsidiary, in

joint application for automatic extension on one form.

which case the amount entered on Form NYC-3A,

Schedule H, Column B, Line 2g(A).

The amount entered on this line should be the es-

TABLE 1 - GENERAL CORPORATION TAX -

timated tax plus the minimum tax for each tax-

FIXED DOLLAR MINIMUM TAX

payer included in the combined group, except the

reporting corporation, which is responsible for the

For a corporation with New York City receipts of:

combined tax.

Not more than $100,000:.............................. $25

The minimum tax for Corporation Tax except for

More than $100,000

Banking Corporation Tax, is calculated based on a

but not over $250,000:.................................. $75

sliding scale (see tables below). The minimum tax

More than $250,000

for Banking Corporation Tax is $125.

but not over $500,000:................................ $175

More than $500,000

NOTE: A combined return member is excused

but not over $1,000,000:............................. $500

from the minimum tax payment if it is not subject

More than $1,000,000

to tax.

but not over $5,000,000:.......................... $1,500

More than $5,000,000

MINIMUM TAX

but not over $25,000,000:........................ $3,500

To determine the Minimum Tax for Corporations

Over $25,000,000:................................... $5,000

except Banking Corporations, use the following

tables. Table 1 is for all corporations subject

TABLE 2 - BUSINESS CORPORATION TAX -

to the General Corporation Tax. This would

FIXED DOLLAR MINIMUM TAX

apply to Subchapter S Corporations and Qualified

For a corporation with New York City receipts of:

Subchapter S Subsidiaries only. Table 2 applies

to all C corporations subject to the Business

Not more than $100,000:.............................. $25

Corporation Tax. The amount of New York City

More than $100,000

receipts for this purpose is the total amount of all

but not over $250,000:.................................. $75

receipts the taxpayer has received in the regular

More than $250,000

course of business from such sources as sales of

but not over $500,000:................................ $175

personal property, services performed, rentals of

More than $500,000

property and royalties. For C corporations filing

but not over $1,000,000:............................. $500

on Forms NYC-2, NYC-2A or NYC-2S, the receipt

More than $1,000,000

amount would be the amount shown on NYC-2,

but not over $5,000,000:.......................... $1,500

Schedule F, Line 2a, Column A, NYC-2A, Sched-

More than $5,000,000

ule F, line 2a, Column D or NYC-2S, Schedule A,

but not over $25,000,000:........................ $3,500

line 14. For S corporations subject to General

More than $25,000,000

Corporation Tax, the receipts amount would be

but not over $50,000,000:........................ $5,000

the same as the amount that would have to be

More than $50,000,000

shown on Form NYC-3L, Schedule H, Column A,

but not over $100,000,000:.................... $10,000

Line 2g. For taxpayers which are part of a com-

More than $100,000,000

bined group in tax years beginning in 2013 or

but not over $250,000,000:.................... $20,000

later, the amount would be (i) for the reporting cor-

More than $250,000,000

poration, the amount on Form NYC-3A, Schedule

but not over $500,000,000:.................... $50,000

H, Column A line 2g(A); and (ii) for corporations

More than $500,000,000

other than the reporting corporation (“sub-

but not over $1,000,000,000:............... $100,000

sidiaries”), the amount on Form NYC-3A/B,

More than $1,000,000,000:..................$200,000

Schedule H, Line 2g(A) in the column for that sub-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4