Instructions for Form ST11-UL

How to file

Claims allowed or denied

This form may be used by utilities service

providers to claim refunds of Minnesota

Complete this form and attach the required

We will review your claim and notify you in

sales tax and any related local sales taxes re‑

documentation (see the next section) and

writing if it is allowed or denied.

mitted on behalf of their customers who are

any additional information that may help

If any part of your claim is allowed, we

now claiming tax exemption for multiple

explain your claim.

will issue you a refund of the excess tax paid

periods.

You must be current in filing your sales

plus interest, if you owe no other amounts.

Use this form when adjusting taxable sales

and use tax returns or your refund may be

If specific period breakdowns are provided,

figures for more than one period. You also

delayed.

interest will be computed per filing period

have the option to file individual amended

from the due date of the original return. If

If your attorney or agent is filing this claim

returns for each period requiring an adjust‑

the claim does not provide breakdowns by

on your behalf, attach Form REV184, Power

ment.

period, interest will be computed from the

of Attorney, and check the box toward the

due date of the last period claimed.

This claim cannot be used to claim refunds

bottom of the form.

of purchases. To file a claim for refund of

We will apply any tax refund, including

Either mail or email Form ST11‑UL and

purchases, you must file individual amend‑

interest, against any outstanding tax you owe

the documentation to one of the addresses

ed returns or a purchaser claim (Form

(within the applicable period of limitations).

listed on the form.

ST11‑PUR).

The balance, if any, will be refunded to you.

Required documentation

To qualify for this refund, you must meet all

If any portion of your claim is denied, you

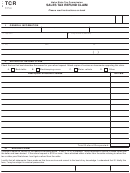

You must provide a schedule with the fol‑

of the following conditions:

may appeal informally to the Department

lowing information (see sample below):

of Revenue’s Appeals Division or formally

• You must be in the business of provid‑

in either the Minnesota Tax Court, Min‑

• month and year tax was invoiced and

ing utility services to customers and be

nesota District Court in the county of your

reported

currently registered to collect and remit

residence or principal place of business, or

• amount of Minnesota sales tax requested

Minnesota sales and use tax.

in District Court for Ramsey County.

• You must be adjusting taxable sales

• amount of local sales taxes requested

Information and assistance

figures for more than one period.

We may request additional documentation

If you need additional information, call

• You must have refunded the tax collected

including copies of exemption certificates.

651‑296‑6181 or 1‑800‑657‑3777. TTY:

back to your customers.

Call 711 for Minnesota Relay. We’ll provide

Documentation may be sent electronically

this information in another format upon

If your Minnesota tax ID number has

on a CD or as an attachment to an email.

request to persons with disabilities.

changed during the claim period, a separate

You must maintain the claim’s supporting

claim form must be filed for each tax ID

documentation for at least 3½ years.

number.

Filing deadlines

Utilities sales adjustment claims must be

filed within 3½ years from the 20th day of

the month in which the tax was originally

due.

Sample of required schedule:

Month/Year

Month/Year

Minnesota Sales

Hennepin County

Transit Improvement

Duluth Sales Tax

tax was invoiced

tax was reported

Tax Claimed

Tax Claimed

Tax Claimed

Claimed

Aug. 08

Aug. 08

$ 252.85

$ 5.84

$ 9.73

$ —

Aug. 08

Sept. 08

97.50

2.25

3.75

—

Sept. 08

Oct. 08

48.69

—

—

7.49

Refund total

$ 399.04

$ 8.09

$ 13.48

$ 7.49

1

1 2

2