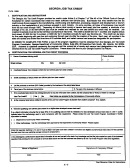

• Name, Account Number and Federal Employer

Consequently, recapture will not occur as a result

Identification Number or Social Security Number:

of employee turnover if average employment does

Enter the information that is requested.

not decrease.

Lines 1a through 2e: Provide information for the

General Carryover Credit Information Based on

credit year.

Form 304

Line 2c: A "major business facility" is a company that

The Major Business Facility Job Tax Credit is computed

meets the job threshold amounts and is engaged in

in the credit year and allowed over a two or three year

business in Virginia in a qualified industry, including

period. This is a nonrefundable credit. Any unused

manufacturing or mining, agriculture, forestry

amount may be carried forward for the next ten taxable

or fishing, or transportation or communications,

years.

and public utilities. An individual facility does not

Schedule A

qualify for the credit if retail is the principal activity

Complete Schedule A to identify each qualifying

of such facility. A "qualified full time employee" is

employee according to the instructions provided.

an ·employee filling a new, permanent full-time

Please complete this section for each year (1 - 6) that

position in a major business facility in Virginia (a

Form 304 is filed.

job of indefinite duration requiring a minimum of 35

hours per week).

Schedule A Worksheet

Line 3: Number of qualifying employees: Complete

Complete the Schedule A Worksheet to calculate

Lines 3a and/or 3b as explained on the form. You

the average number of qualifying employees in the

may use substitute Schedules A and B if they contain

current year. There should be one line completed for

the same data.

each applicable section. Enter the total from Column

D on Form 304, Line 3b.

Line 3a: If this is the credit year (the first taxable year

following the taxable year in which the major business

Schedule B (To be completed for the credit year)

facility was established or expanded), complete

Complete Schedule B to compute the number of

Schedules A and B, and enter the amount from

qualifying employees on a monthly basis.

Schedule B, Line N.

Lines A through L:

Line 3b: Enter the number of qualifying full-time

Column A On each line, enter the number of

employees reported on the quarterly employment

qualified full-time or equivalent full-time

tax reports filed with the Virginia Employment

employees who filled new permanent

Commission for the current year. The number of

(indefinite duration) full-time positions

qualifying employees must be calculated to two

in Virginia and were employed for the

decimal places.

same number of months during the

Lines 3c through 3e: Provide the information

credit year.

requested. If you have questions, call 804-786-2992.

Column B The number of months preprinted in

Line 6: Multiply the amount on Line 5 by $1,000.

Column B should be the number of

Line 7: For the credit year and the subsequent taxable

months that the qualifying employees

years, enter

/

of the amount on Line 6. However,

1

in Column A on the same line worked

3

you may enter

/

of the credit amount on Line 6 if

1

during the credit year.

2

your credit year's taxable year begins on or after

Column C For each line, multiply the amount in

January 1, 2009, but before January 1, 2015.

Column A by the amount in Column B.

Exception: Affiliated companies that aggregated

Lines M and N:

jobs in order to qualify for this credit and file separate

Line M

Add the amounts in Column C, Lines A

Virginia returns must enter the prorated current year

through L.

credit amount here and attach a statement reflecting

the prorated amount for each affiliated company.

Line N

Divide Line M by 12. Enter here and on

Form 304, Line 3a.

Line 8: Credit to be recaptured this year: If the average

number of qualifying employees, as determined by

Schedule C

your current year quarterly filings with the Virginia

Tier 1 and Tier 2 pass-through entities must complete

Employment Commission (Line 3b), is less than

Schedule C for each year that a credit is earned

the average number of qualifying employees for

(generally years 1 - 3).

your credit year (Line 3a), you may be required

to recapture all or a portion of the Major Business

In addition, a pass-through entity is also required to

Facility Job Tax Credit.

complete a Form 502 and send each participant a copy

of the pass-through entity’s certification letter to attach

Recapture is based on qualified full-time employees,

to its income tax return and a Schedule VK-1.

but is not contingent upon specific employees.

Page 7

1

1 2

2 3

3 4

4 5

5 6

6 7

7