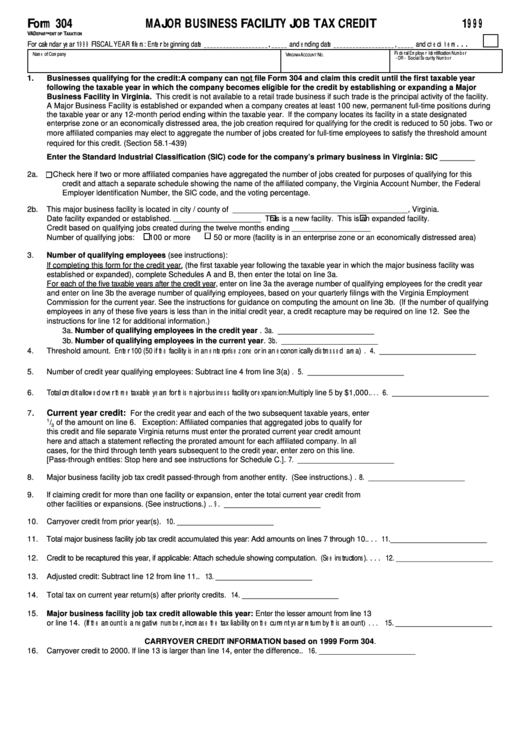

Form 304 - Major Business Facility Job Tax Credit - 1999

ADVERTISEMENT

Form 304

MAJOR BUSI NESS FACI L I TY JOB TAX CREDIT

19 9 9

V A D

T

EPARTMENT OF

AXATION

. . .

For cal e ndar ye ar 19 9 9 FISCAL YEAR f il e rs : Ent e r be ginning dat e _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ , _ _ _ _ _ and e nding dat e _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ , _ _ _ _ _ and ch e ck h e re

Fe de ral Em pl oye r Ide nt if icat ion Num b e r

Nam e of Com pany

V

A

N

.

IRGINIA

CCOUNT

O

- OR - Social Se curit y Num b e r

1.

Businesses qualifying for the credit: A company can not file Form 304 and claim this credit until the first taxable year

following the taxable year in which the company becomes eligible for the credit by establishing or expanding a Major

Business Facility in Virginia. This credit is not available to a retail trade business if such trade is the principal activity of the facility.

A Major Business Facility is established or expanded when a company creates at least 100 new, permanent full-time positions during

the taxable year or any 12-month period ending within the taxable year. If the company locates its facility in a state designated

enterprise zone or an economically distressed area, the job creation required for qualifying for the credit is reduced to 50 jobs. Two or

more affiliated companies may elect to aggregate the number of jobs created for full-time employees to satisfy the threshold amount

required for this credit. (Section 58.1-439)

Enter the Standard Industrial Classification (SIC) code for the company’ s primary business in Virginia: SIC ________

2a.

Check here if two or more affiliated companies have aggregated the number of jobs created for purposes of qualifying for this

credit and attach a separate schedule showing the name of the affiliated company, the Virginia Account Number, the Federal

Employer Identification Number, the SIC code, and the voting percentage.

2b.

This major business facility is located in city / county of ________________________________________, Virginia.

Date facility expanded or established. ____________________

This is a new facility.

This is an expanded facility.

Credit based on qualifying jobs created during the twelve months ending __________________

Number of qualifying jobs:

100 or more

50 or more (facility is in an enterprise zone or an economically distressed area)

3.

Number of qualifying employees (see instructions):

If completing this form for the credit year, (the first taxable year following the taxable year in which the major business facility was

established or expanded), complete Schedules A and B, then enter the total on line 3a.

For each of the five taxable years after the credit year, enter on line 3a the average number of qualifying employees for the credit year

and enter on line 3b the average number of qualifying employees, based on your quarterly filings with the Virginia Employment

Commission for the current year. See the instructions for guidance on computing the amount on line 3b. (If the number of qualifying

employees in any of these five years is less than in the initial credit year, a credit recapture may be required on line 12. See the

instructions for line 12 for additional information.)

3a. Number of qualifying employees in the credit year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a. ______________________

3b. Number of qualifying employees in the current year . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3b. ______________________

Threshold amount. Ent e r 100 (50 if t h e f acil it y is in an e nt e rpris e z one or in an e conom ical l y dis t re s s e d are a) . . . . . . 4. ______________________

4.

Number of credit year qualifying employees: Subtract line 4 from line 3(a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. ______________________

5.

Tot al cre dit al l ow e d ove r t h re e t axabl e ye ars f or t h is m aj or bus ine s s f acil it y or e xpans ion: Multiply line 5 by $1,000. . . . 6. ______________________

6.

.

Current year credit:

7

For the credit year and each of the two subsequent taxable years, enter

1

/ of the amount on line 6. Exception: Affiliated companies that aggregated jobs to qualify for

3

this credit and file separate Virginia returns must enter the prorated current year credit amount

here and attach a statement reflecting the prorated amount for each affiliated company. In all

cases, for the third through tenth years subsequent to the credit year, enter zero on this line.

[Pass-through entities: Stop here and see instructions for Schedule C.] . . . . . . . . . . . . . . . . . . . . . . . . 7. ______________________

Major business facility job tax credit passed-through from another entity. (See instructions.) . . . . . . . . 8. ______________________

8.

9.

If claiming credit for more than one facility or expansion, enter the total current year credit from

other facilities or expansions. (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 . ______________________

Carryover credit from prior year(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. ______________________

10.

Total major business facility job tax credit accumulated this year: Add amounts on lines 7 through 10. . . . 11. ______________________

11.

Credit to be recaptured this year, if applicable: Attach schedule showing computation. (Se e ins t ruct ions ). . . . 12. ______________________

12.

Adjusted credit: Subtract line 12 from line 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. ______________________

13.

Total tax on current year return(s) after priority credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. ______________________

14.

15.

Major business facility job tax credit allowable this year: Enter the lesser amount from line 13

or line 14. (I f t h e am ount is a ne gat ive num be r, incre as e t h e t ax l iabil it y on t h e curre nt ye ar re t urn by t h is am ount ) . . . 15. ______________________

CARRYOVER CREDIT INFORMATION based on 1999 Form 304.

Carryover credit to 2000. If line 13 is larger than line 14, enter the difference. . . . . . . . . . . . . . . . . . . . 16. ______________________

16.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4