If you answer “NO” to both questions, you do not have to complete this worksheet.

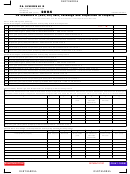

Part I. -

Complete this part if you answered Question 1 only “YES”.

1a. Fair market value of property used for residential purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

1b. Fair market value of entire property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

1c. Residential Use Factor (Divide Line 1a by Line 1b). Enter here and on Line 2. (page 4) . . . . . . . . . . . . .

%

Part II. - Complete this part if you answered Question 2 only “YES”, and Part I above does not apply.

2a. Total square footage used for residential purposes. Important. Do not include any portion that was subject

to depreciation at any time during the holding period. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

sq. ft.

2b. Total square footage of entire property. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

sq. ft.

2c. Residential Use Factor (Divide Line 2a by Line 2b). Enter here and on Line 2. (page 4) . . . . . . . . . . . . .

%

Part III. - Complete this part if you answered both Question 1 and Question 2 “YES”. You must complete Part I and II.

3. Residential Use Factor (Multiply the percentage on Line 1c by the percentage on Line 2c).

Enter here and on Line 2. (page 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

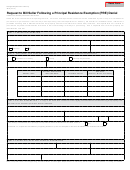

Taxable Sale of a Principal Residence Worksheet (Page 4)

Instructions.

Enter your name(s), address of the residence sold, and Social Security Number(s).

General Information.

-

Complete Lines 1a through 1d.

Lines 1a and 1b are self-explanatory.

Line 1c. If you owned your principal residence with another person(s), enter your ownership interest as a percentage.

Example 1. You and your spouse jointly own your home. You each qualify for the exclusion and elect to file separate PA returns.

Your ownership percentage is 50% (0.50).

Example 2. You, your sister, and your brother equally own the home. You are the only one who lives in the home. You meet all

the requirements for the exclusion. They do not qualify. Your ownership percentage is 33.33% (0.33).

Line 1d. Enter the face value of any mortgage, note, or other financial instrument from which you will receive periodic payments of

principal and/or interest from this sale.

Computing the Taxable Gain or Loss

Line 2. Enter your Residential Use Factor, from above. If you did not calculate a Residential Use Factor, enter 100%.

Line 3. Enter your share of the gross sales price or fair market value of cash and property received for the entire property, including the

portion of the property used for nonresidential purposes, less your share of applicable expenses of sale, real estate commissions,

transfer taxes, etc.

Lines 4 and 5 are self-explanatory.

Line 6. Enter the adjusted basis of the entire property. This usually is the same basis you use for federal purposes.

Line 7. Enter the adjusted basis of the portion of the property that you used for nonresidential purposes.

Line 8 is self-explanatory.

Lines 9, 10, and 11.

Complete these lines only if you acquired your property before June 1, 1971. You must determine your alter-

native basis on Lines 9 and 10 using the methods prescribed on PA Schedule D-71, Gain or Loss on Property

Acquired Prior to June 1, 1971, (Form REV-1742) for determining Alternative Basis and Determination of Fair

Market Value as of June 1, 1971. The alternative basis is Column e on PA Schedule D-71.

Line 12 is the gain or loss on your residence.

•

If Line 8 is greater than Line 4 and no depreciation deductions were allowed or allowable with respect to your residence, enter a zero

on Line 12.

•

If Line 8 is greater than Line 4 and depreciation deductions were allowed or allowable with respect to your residence, subtract Line 8

from Line 4 and enter the difference as a loss on Line 12.

•

Otherwise, subtract Line 8 (or the larger of Line 8 or Line 11, if the residence was acquired prior to June 1, 1971) from Line 4 and enter

the difference on Line 12 as a gain.

Line 13 is the gain or loss on the entire property computed without regard to the gain or loss on your residence.

•

If the property was acquired after May 31, 1971, subtract Line 7 from Line 5 and enter the gain or loss.

•

If the property was acquired before June 1, 1971 and both Line 7 and Line 10 are less than Line 5, subtract the larger of Line 7 or Line 10

from Line 5 and enter the difference as a gain.

•

If the property was acquired before June 1, 1971 and Line 7 is greater than Line 5, subtract Line 5 from Line 7 and enter the difference

as a loss.

•

If the property was acquired before June 1, 1971 and Line 5 is not greater than Line 7 and Line 5 is not less than Line 10, enter zero.

NEXT PAGE

PAGE 3

1

1 2

2 3

3 4

4