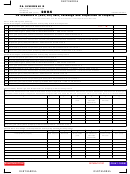

PA Schedule 19

0203420047

Taxable Sale of a

Principal Residence

START

Worksheet

PA-19 (09–08) (FI)

2003

PA DEPARTMENT OF REVENUE

The Department of Revenue requires this worksheet to be included with a PA tax return whenever there is a

gain or loss on the business or rental use portion of your principal residence.

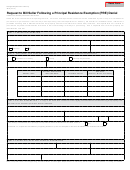

Your Social Security Number

Name(s) as shown on PA-40

Spouse’s Social Security Number

Address of residence sold: (First Line of Address)

(Second Line of Address)

City

State

ZIP Code

General Information

General Information

1a. Date property was sold

1b. Date property was acquired

1c. Percentage ownership interest in property

% (calculated to two decimal places)

1d. Enter the face amount of any mortgage, note or other financial instrument on which you will receive periodic payments of principal

and/or interest from this sale: $

Computation of Taxable Gain or Loss

Computing the Taxable Gain or Loss

2. Enter your Residential Use Factor from page 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

%

3. Gross proceeds, less expenses of sale, for entire property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Multiply Line 3 by the percentage on Line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Subtract Line 4 from Line 3 (Enter zero if you answered “NO” to the Residential Use

Worksheet questions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Adjusted basis of entire property, including property used for nonresidential purposes . . . . . . . . . .

6.

7. Adjusted basis of property used for nonresidential purposes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Subtract Line 7 from Line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

Complete Lines 9, 10, and 11 only if you acquired your residence before June 1, 1971.

You must first complete PA Schedule D-71, REV-1742.

9. Alternative basis of entire property, including property used for nonresidential purposes. . . . . . . . .

9.

10. Alternative basis of property used for nonresidential purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. Subtract Line 10 from Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. Net gain or loss on residential property. Read the instructions.

Fill in the oval if a loss. . . . .

12.

13. Net gain or a loss on nonresidential property. Read the instructions.

Fill in the oval if a loss. . . . .

13.

If you have a gain on Line 13, include the gain on your PA Schedule D.

If you have a loss on Line 13, include the loss on your PA Schedule D.

RETURN TO PAGE ONE

PRINT FORM

Reset Entire Form

PAGE 4

0203420047

0203420047

1

1 2

2 3

3 4

4