Clear Form

2105 (Rev. 11-01)

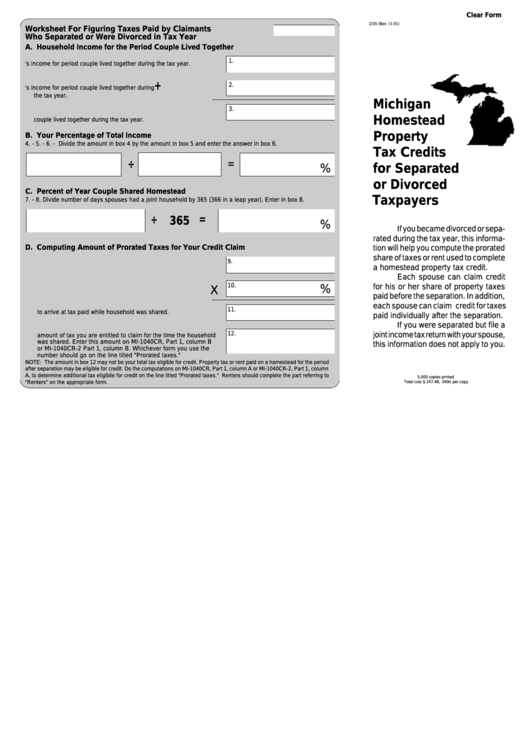

Worksheet For Figuring Taxes Paid by Claimants

Who Separated or Were Divorced in Tax Year

A. Household Income for the Period Couple Lived Together

1.

1. Wife's income for period couple lived together during the tax year.

+

2.

2. Husband's income for period couple lived together during

the tax year.

3.

3. Add both incomes together for total household income for period

couple lived together during the tax year.

B. Your Percentage of Total Income

4. - 5. - 6. - Divide the amount in box 4 by the amount in box 5 and enter the answer in box 6.

4. Enter your income from box 1 or 2.

5. Enter amount from box 3.

6. Your percentage of total income.

=

÷

%

C. Percent of Year Couple Shared Homestead

7. - 8. Divide number of days spouses had a joint household by 365 (366 in a leap year). Enter in box 8.

7. Number of days couple shared homestead.

8. Percent of year couple shared homestead.

=

÷

365

%

If you became divorced or sepa-

rated during the tax year, this informa-

D. Computing Amount of Prorated Taxes for Your Credit Claim

tion will help you compute the prorated

share of taxes or rent used to complete

9.

9. Total allowable property tax billed on homestead during the tax year.

a homestead property tax credit.

Each spouse can claim credit

10.

for his or her share of property taxes

%

10. Enter percentage from box 8.

X

paid before the separation. In addition,

11. Multiply amount in box 9 by percentage in box 10

each spouse can claim credit for taxes

11.

to arrive at tax paid while household was shared.

paid individually after the separation.

If you were separated but file a

12. Multiply amount in box 11 by percentage in box 6 to determine the

12.

joint income tax return with your spouse,

amount of tax you are entitled to claim for the time the household

was shared. Enter this amount on MI-1040CR, Part 1, column B

this information does not apply to you.

or MI-1040CR-2 Part 1, column B. Whichever form you use the

number should go on the line titled "Prorated taxes."

NOTE: The amount in box 12 may not be your total tax eligible for credit. Property tax or rent paid on a homestead for the period

after separation may be eligible for credit. Do the computations on MI-1040CR, Part 1, column A or MI-1040CR-2, Part 1, column

A, to determine additional tax eligibile for credit on the line titled "Prorated taxes." Renters should complete the part referring to

5,000 copies printed

"Renters" on the appropriate form.

Total cost $ 247.48; .049¢ per copy

1

1 2

2