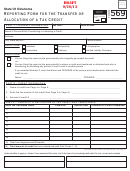

Form 569 - Page 4

Reporting Form for the Transfer or Allocation of a Tax Credit

Title 68 OS Section 2357.1A-2 and Rule 710:50-3-55

Name of Credits that are Allocable or Transferable

Allocable / Transferable

1

Oklahoma Investment/New Jobs Credit

Allocable

2

Coal Credit (Credits earned prior to January 1, 2014 must be transferred by

Allocable

Transferable

December 31, 2013. Credits earned on or after January 1, 2014

may not be transferred.)

3

Credit for Investment in a Clean-Burning Motor Vehicle Fuel Property

Allocable

4

Small Business Capital Credit (For tax years beginning before January 1, 2012.)

Allocable

5

Small Business Guaranty Fee Credit (Effective January 1, 2014 the credit was repealed)

Allocable

6

Credit for Food Service Establishments that Pay for Hepatitis A Vaccination for their Employees Allocable

(Effective January 1, 2014 the credit was repealed)

7

Credit for Energy Assistance Fund Contribution

Allocable

(Effective January 1, 2014 the credit was repealed)

8

Credit for Venture Capital Investment

Transferable

(For tax years beginning before 1/1/09. Transferable for 3 years.)

9

Credit for Hazardous Waste Control

Allocable

(Effective January 1, 2014 the credit was repealed)

10

Credit for Employers Providing Child Care Programs

Allocable

(Effective January 1, 2014 the credit was repealed)

11

Credit for Entities in the Business of Providing Child Care Services

Allocable

12

Credit for Commercial Space Industries

Allocable

(Effective January 1, 2014 the credit was repealed)

13

Credit for Tourism Development or Qualified Media Production Facility

Allocable

(Effective January 1, 2014 the credit was repealed)

14

Oklahoma Local Development and Enterprise Zone Incentive Leverage Act

Allocable

(Effective January 1, 2014 the credit was repealed)

15

Credit for Qualified Rehabilitation Expenditures

Allocable

Transferable

16

Credit for Space Transportation Vehicle Provider

Transferable

(For tax years ending before 1/1/09. Transferable for 3 years.)

17

Rural Small Business Capital Credit

Allocable

(For tax years beginning before January 1, 2012.)

18

Credit for Electricity Generated by Zero-Emission Facilities (Credits earned on or after Allocable

Transferable

January 1, 2014 may not be transferred)

19

Credit for Financial Institutions Making Loans under the Rural Economic Development Loan Act Allocable

20

Credit for Manufacturers of Small Wind Turbines

Allocable

Transferable

(For tax years ending on or before December 31, 2012)

21

Credit for Qualified Ethanol Facilities (Effective January 1, 2014 the credit was repealed)

Allocable

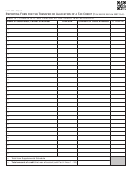

1

1 2

2 3

3 4

4 5

5