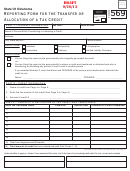

Form 569 - Page 5

Reporting Form for the Transfer or Allocation of a Tax Credit

Title 68 OS Section 2357.1A-2 and Rule 710:50-3-55

Name of Credits that are Allocable or Transferable

Allocable / Transferable

22

Poultry Litter Credit (For tax years ending on or before December 31, 2013)

Allocable

23

Credit for Qualified Biodiesel Facilities

Allocable

(Effective January 1, 2014 the credit was repealed)

24

Film or Music Project Credit (For tax years ending before January 1, 2015)

Allocable

25

Credit for Breeders of Specially Trained Canines

Allocable

(Effective November 1, 2013 the credit was repealed)

26

Credit for Wages Paid to an Injured Employee

Allocable

(For tax years ending before January 1, 2015)

27

Credit for Modification Expenses Paid for an Injured Employee

Allocable

28

Dry Fire Hydrant Credit (Effective January 1, 2014 the credit was repealed)

Allocable

29

Credit for the Construction of Energy Efficient Homes

Allocable

Transferable

30

Credit for Railroad Modernization

Allocable

Transferable

31

Research and Development New Jobs Credit

Allocable

(Effective January 1, 2014 the credit was repealed)

32

Credit for Stafford Loan Origination Fee

Allocable

(Effective January 1, 2014 the credit was repealed)

33

Gas Used in Manufacturing Credit (Effective January 1, 2014 the credit was repealed) Allocable

34

Credit for Biomedical Research Contribution

Allocable

35

Credit for Employers in the Aerospace Sector

Allocable

36

Wire Transfer Fee Credit

Allocable

37

Credit for Manufacturers of Electric Vehicles

Allocable

(Effective January 1, 2014 the credit was repealed)

38

Credit for Cancer Research Contribution

Allocable

39

Oklahoma Capital Investment Board Tax Credit

Allocable

Transferable

40

Credit for Contributions to a Scholarship-Granting Organization

Allocable

41

Credit for Contributions to an Educational Improvement Grant Organization

Allocable

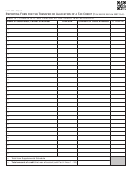

1

1 2

2 3

3 4

4 5

5