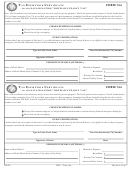

Page 4

39. Has the issuer included a statement as to whether the bonds are under review in any court (other than a federal court),

administrative agency, commission, or other proceeding (and identified the proceeding)

Yes

Page number

N/A

40. Has the issuer included a statement as to whether the issuer knew or reasonably expected on the issue date that the violation might

occur

Yes

N/A

Page number

41. Has the issuer included a description of the policies or procedures which have been or will be implemented to prevent this type of

violation from recurring with this or any other bond issues

Yes

N/A

Page number

42. Has the issuer included a statement that the request for a closing agreement was promptly undertaken upon the discovery of the

identified violation, including the date(s) of the violation, the date and circumstances surrounding the discovery of the violation, and

the date and nature of any actions taken in response to the discovery of violation (e.g., redemption, defeasance)

Yes

Page number

N/A

Identification of Previous TEB VCAP or Private Letter Ruling Requests

See IRM 7.2.3.2.1(2)(F)&(G) for more information

43. Has the issuer identified any previous and contemporaneous TEB VCAP requests (including anonymous requests) submitted either:

(1) with respect to the bond issue that is the subject of the request; or (2) pertaining to a violation that is of the same type as the

subject of the request provided that such request was submitted within the past five years, including the name(s) of the related bond

issue(s), brief summaries of the violation(s) identified and resolution thereof; or, if no previous or contemporary request has been

submitted, has the issuer included a statement to that effect

Yes

Page number

N/A

44. Has the issuer identified all previous or contemporaneous private letter ruling requests submitted by the issuer with respect to the

bonds and relating to the violation which is the subject of the TEB VCAP request, including a brief summary of the matters

addressed therein; or, if no previous or contemporaneous private letter ruling request has been submitted, has the issuer included a

statement to that effect

Yes

N/A

Page number

Conflicts, Disclosure, 3rd Party Fault, Other

See IRM 7.2.3.2.1(2)(H) through (K) for more information

45. Has the issuer described any explanation the representative(s) or other professionals have made to the issuer regarding conflicts of

interests relating to the bonds that might exist under Circular 230

Yes

Page number

N/A

46. Has the issuer identified a violation that has been disclosed on the Municipal Securities Rulemaking Board’s Electronic Municipal

Market Access System (EMMA) or to any state or local taxing jurisdiction that grants tax-advantaged treatment to the issuer’s

bonds, including a statement describing the disclosure and how it was made; or, if no disclosure has been made, a statement to that

effect

Yes

Page number

N/A

47. If the issuer wishes to assert that the violation was caused by another party and requests TEB to consider this as a factor in

determining an appropriate resolution, has the issuer included a statement that the violation was due to the acts or omissions of a

person or persons other than the issuer, together with a description of the circumstances surrounding the violation thereof, and any

information that the issuer has regarding such acts or omissions (including an identification of the person or persons whose acts or

omissions caused the violation)

Yes

Page number

N/A

48. Has the issuer attached an explanation of any other information relevant to the matters contained in or resolution of the TEB VCAP

request

Yes

N/A

Page number

Written Post-Issuance Compliance Monitoring Procedures

49. Has the issuer included an affirmative or negative statement as to whether the issuer has adopted comprehensive written

procedures intended to promote post-issuance compliance with, and to prevent violations of, the federal tax requirements for tax-

advantaged bonds? IRM 7.2.3.2.1(3)

Yes

N/A

Page number

14429

Catalog Number 60719A

Form

(3-2013)

1

1 2

2 3

3 4

4 5

5