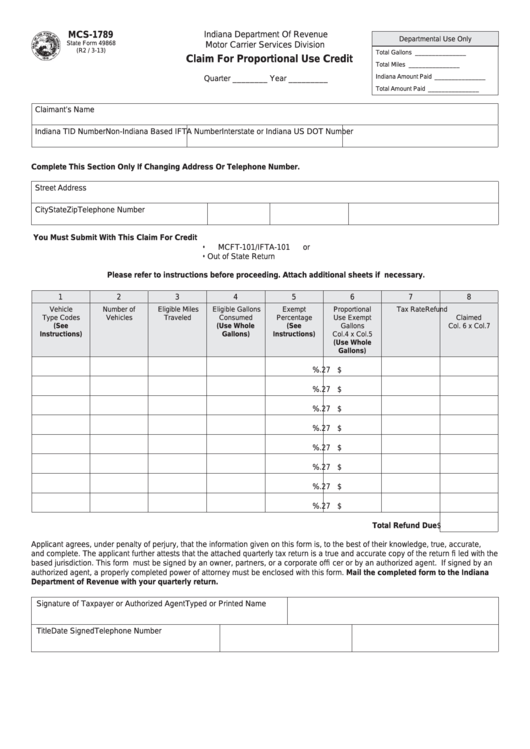

MCS-1789

Indiana Department Of Revenue

Departmental Use Only

State Form 49868

Motor Carrier Services Division

(R2 / 3-13)

Total Gallons

_______________

Claim For Proportional Use Credit

Total Miles

_______________

Indiana Amount Paid _______________

Quarter ________ Year _________

Total Amount Paid

_______________

Claimant’s Name

Indiana TID Number

Non-Indiana Based IFTA Number

Interstate or Indiana US DOT Number

Complete This Section Only If Changing Address Or Telephone Number.

Street Address

City

State

Zip

Telephone Number

You Must Submit With This Claim For Credit

•

MCFT-101/IFTA-101 or

•

Out of State Return

Please refer to instructions before proceeding. Attach additional sheets if necessary.

1

2

3

4

5

6

7

8

Vehicle

Number of

Eligible Miles

Eligible Gallons

Exempt

Proportional

Tax Rate

Refund

Type Codes

Vehicles

Traveled

Consumed

Percentage

Use Exempt

Claimed

(See

(Use Whole

(See

Gallons

Col. 6 x Col.7

Instructions)

Gallons)

Instructions)

Col.4 x Col.5

(Use Whole

Gallons)

%

.27 $

%

.27 $

%

.27 $

%

.27 $

%

.27 $

%

.27 $

%

.27 $

%

.27 $

Total Refund Due $

Applicant agrees, under penalty of perjury, that the information given on this form is, to the best of their knowledge, true, accurate,

and complete. The applicant further attests that the attached quarterly tax return is a true and accurate copy of the return fi led with the

based jurisdiction. This form must be signed by an owner, partners, or a corporate offi cer or by an authorized agent. If signed by an

authorized agent, a properly completed power of attorney must be enclosed with this form. Mail the completed form to the Indiana

Department of Revenue with your quarterly return.

Signature of Taxpayer or Authorized Agent

Typed or Printed Name

Title

Date Signed

Telephone Number

1

1 2

2 3

3