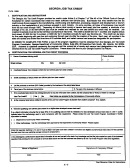

Schedule A Worksheet

Taxable Year

___________

.

Use to Calculate Line 3b of Form 304

Name as it Appears on Form 304

FEIN or Social Security Number

Use this worksheet to calculate Form 304, Line 3b.

Complete the applicable sections for the current taxable year. There should be one line completed for each applicable section.

. . . . . . . . . . . . . . . . . . . . . . . . . . .

Number of employees prior to first expansion. For a new facility, enter 0.

A.

B.

C.

D.

Number of qualifying

Number of qualifying

Number of qualifying

Net amount of

employees in the credit

employees added.

employees terminated.

qualifying employees.

year. Enter on Form

(Columns A + B - C)

304, Line 3a.

Section 1 - First expansion

Credit Year

Year 1

Taxable Year 20 ___ ___

Year 2

Taxable Year 20 ___ ___

Year 3

Taxable Year 20 ___ ___

Year 4

Taxable Year 20 ___ ___

Year 5

Taxable Year 20 ___ ___

Year 6

Taxable Year 20 ___ ___

Section 2 - Second expansion [If applicable]

Credit Year

Year 1

Taxable Year 20 ___ ___

Year 2

Taxable Year 20 ___ ___

Year 3

Taxable Year 20 ___ ___

Year 4

Taxable Year 20 ___ ___

Year 5

Taxable Year 20 ___ ___

Year 6

Taxable Year 20 ___ ___

Section 3 - Third expansion [If applicable]

Credit Year

Year 1

Taxable Year 20 ___ ___

Year 2

Taxable Year 20 ___ ___

Year 3

Taxable Year 20 ___ ___

Year 4

Taxable Year 20 ___ ___

Year 5

Taxable Year 20 ___ ___

Year 6

Taxable Year 20 ___ ___

Total of Column D. Enter on Form 304, Line 3b.

Attach to Form 304, Major Business Facility Job Tax Credit.

To obtain this worksheet in a spreadsheet format, visit and go to the "What's New for Tax Credits" section.

Page 3

1

1 2

2 3

3 4

4 5

5 6

6 7

7