Local Schedule G - Credit For Income Taxes Paid By Local Resident To States Other Than Pa

ADVERTISEMENT

Taxpayer Name: ____________________________

Social Security Number: ________________________

Tax Year: _________

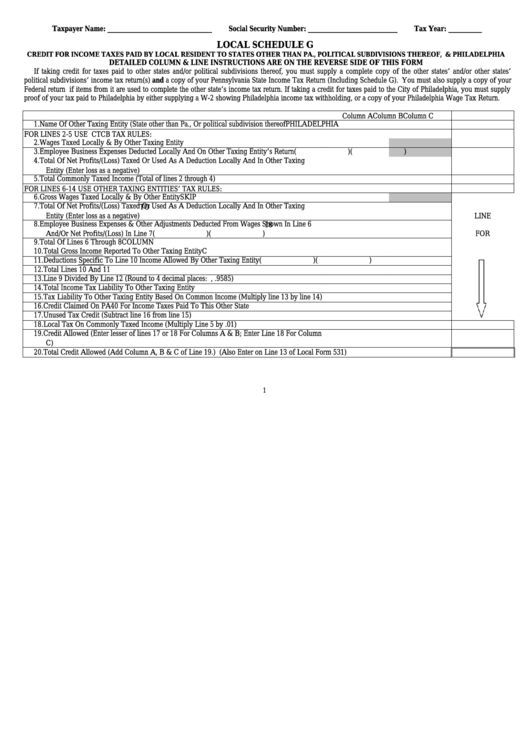

LOCAL SCHEDULE G

CREDIT FOR INCOME TAXES PAID BY LOCAL RESIDENT TO STATES OTHER THAN PA., POLITICAL SUBDIVISIONS THEREOF, & PHILADELPHIA

DETAILED COLUMN & LINE INSTRUCTIONS ARE ON THE REVERSE SIDE OF THIS FORM

If taking credit for taxes paid to other states and/or political subdivisions thereof, you must supply a complete copy of the other states’ and/or other states’

political subdivisions’ income tax return(s) and a copy of your Pennsylvania State Income Tax Return (Including Schedule G). You must also supply a copy of your

Federal return if items from it are used to complete the other state’s income tax return. If taking a credit for taxes paid to the City of Philadelphia, you must supply

proof of your tax paid to Philadelphia by either supplying a W-2 showing Philadelphia income tax withholding, or a copy of your Philadelphia Wage Tax Return.

Column A

Column B

Column C

1. Name Of Other Taxing Entity (State other than Pa., Or political subdivision thereof

PHILADELPHIA

FOR LINES 2-5 USE CTCB TAX RULES:

2. Wages Taxed Locally & By Other Taxing Entity

3. Employee Business Expenses Deducted Locally And On Other Taxing Entity’s Return

(

)

(

)

4. Total Of Net Profits/(Loss) Taxed Or Used As A Deduction Locally And In Other Taxing

Entity (Enter loss as a negative)

5. Total Commonly Taxed Income (Total of lines 2 through 4)

FOR LINES 6-14 USE OTHER TAXING ENTITIES’ TAX RULES:

6. Gross Wages Taxed Locally & By Other Entity

SKIP

7. Total Of Net Profits/(Loss) Taxed Or Used As A Deduction Locally And In Other Taxing

TO

Entity (Enter loss as a negative)

LINE

8. Employee Business Expenses & Other Adjustments Deducted From Wages Shown In Line 6

18

And/Or Net Profits/(Loss) In Line 7

(

) (

)

FOR

9. Total Of Lines 6 Through 8

COLUMN

10. Total Gross Income Reported To Other Taxing Entity

C

11. Deductions Specific To Line 10 Income Allowed By Other Taxing Entity

(

) (

)

12. Total Lines 10 And 11

13. Line 9 Divided By Line 12 (Round to 4 decimal places: e.g., .9585)

14. Total Income Tax Liability To Other Taxing Entity

15. Tax Liability To Other Taxing Entity Based On Common Income (Multiply line 13 by line 14)

16. Credit Claimed On PA40 For Income Taxes Paid To This Other State

17. Unused Tax Credit (Subtract line 16 from line 15)

18. Local Tax On Commonly Taxed Income (Multiply Line 5 by .01)

19. Credit Allowed (Enter lesser of lines 17 or 18 For Columns A & B; Enter Line 18 For Column

C)

20. Total Credit Allowed (Add Column A, B & C of Line 19.) (Also Enter on Line 13 of Local Form 531)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1