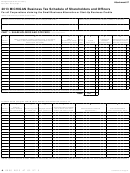

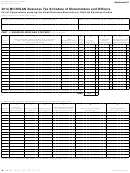

Form 4577 - Michigan Business Tax Schedule Of Shareholders And Officers - 2012 Page 3

ADVERTISEMENT

Instructions for Form 4577

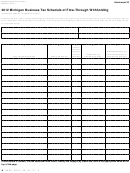

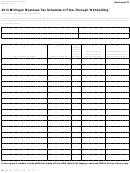

Michigan Business Tax (MBT) Schedule of Shareholders and Officers

For all Corporations claiming the Small Business Alternative or Start-Up Business Credits

2O. It is essential that this numbering system is followed.) All

Purpose

shareholders’ family members, as defined by IRC § 318(a)(1),

are considered shareholders and must be listed in Part 1 and

To determine eligibility for all Corporations to qualify for

Part 2 if they receive compensation from the business. List all

the Small Business Alternative Credit. Corporation means a

taxpayer that is required or has elected to file as a Corporation

shareholders and C Corporation officers who:

under the Internal Revenue Code (IRC).

• Are employees of the Corporation;

Fiscal Year Filers: See “Supplemental Instructions for

• Are directors of the Corporation; or

Standard Fiscal MBT Filers” in the MBT Forms and

• Own 10 percent or more of the stock of the Corporation,

Instructions for Standard Taxpayers (Form 4600).

including those by attribution.

General Instructions

Shareholder means a person who owns outstanding stock in

the Corporation. An Individual is considered as owning the

If filing as a Corporation (including Limited Liability

stock owned, directly or indirectly, by or for family members

Companies federally taxed as such) and claiming a Small

as defined by IRC § 318(a)(1). An officer of a C Corporation

Business Alternative Credit, complete this form and include it

includes the chairperson of the board, president, vice president,

as part of the annual return to report:

secretary, and treasurer, or persons performing similar duties.

• Shareholder and C Corporation officer qualifications for the

Outstanding stock means all stock of record, regardless of

Small Business Alternative Credit;

class, value, or voting rights, but outstanding stock does not

• Compensation and director fees of active shareholders and

include treasury stock.

all C Corporation officers for the computation of the Small

If more lines are needed for listing the shareholders and C

Business Alternative Credit.

Corporation officers, include additional copies of this form.

Note: A member of a Limited Liability Company (LLC) is

Complete the taxpayer name and account number on each copy

characterized for MBT purposes as a shareholder if the LLC is

(and UBG member if applicable), and lines 1 and 2 as necessary.

taxed as a corporation for federal purposes.

If using more than one copy of the form, continue the sequential

number system for the Member Number in columns A, H and O.

Note: A federally disregarded entity is required to file as if

it were a sole proprietorship if owned by an individual, or a

Note: Rules of attribution in IRC § 318(a)(1) do not

branch or division if owned by another business entity.

differentiate between an adult and a minor child.

This form also is required to be completed and included as

Columns B and C: Identify each shareholder (including

part of the return whenever a corporation claims a Start-Up

Corporations, Trusts, or Partnerships) and C Corporation

Business Credit. To qualify for the Start-Up Business Credit, the

officers by name and Social Security number. Corporations,

compensation, director fees, or distributive shares paid by the

Trusts, and Partnerships should be identified using the Federal

taxpayer to a shareholder of a C Corporation or S Corporation, or

Employer Identification Number (FEIN) or Michigan Treasury

an officer of a C Corporation, cannot exceed $135,000.

(TR) assigned number.

Line-by-Line Instructions

Note: Column C: An individual or foreign entity that does

not have a Social Security number or FEIN may enter in

Lines not listed are explained on the form.

Column C “APPLD FOR” (an abbreviation for “applied for”) or

“FOREIGNUS” (an abbreviation for “foreign filer”).

Name and Account Number: Enter name and account number

as reported on page 1 of the MBT Annual Return (Form 4567).

Column e: Enter the percentage of outstanding stock

each shareholder or C Corporation officer owns directly.

Unitary Business Groups (UBGs): Complete one form for

If a shareholder owned stock for a period less than the

each member that is a corporation (including an entity taxed

Corporation’s tax year, multiply that shareholder’s percentage

federally as such). Enter the Designated Member name in the

Taxpayer Name field and the member to whom the schedule

of ownership by the number of months owned and divide the

applies on the line below. On the copy filed to report the DM’s

result by the number of months in the Corporation’s tax year.

data (if applicable), enter the DM’s name and account number

Taxpayers must account for 100 percent of the stock. If it is not

on each line.

accounted for, processing of the return may be delayed.

PART 1: SHAREHOLDERS AND OFFICERS

Column F: Enter the percentage of outstanding stock each

Line 1 (Columns A through N): In column 1A, assign

shareholder owns, including attribution of ownership from family

numbers (beginning with 1) to all shareholders and C

members under IRC § 318(a)(1). If no attribution exists, enter the

Corporation officers in order of percentage of stock ownership

percentage from column E in column G and leave column F blank.

(percentage in column G), starting with the highest percentage

first. (Repeat this numbering in Part 1, line 1H, and Part 2, line

Column G: When reporting ownership of a person who

99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5