Form 4577 - Michigan Business Tax Schedule Of Shareholders And Officers - 2012 Page 4

ADVERTISEMENT

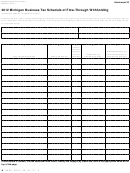

is an active shareholder, do not include in Column G any

Columns I, J, and K: Fiscal Year Filers: See “Supplemental

stock ownership attributed to this person from another

Instructions for Standard Fiscal MBT Filers” in Form 4600.

active shareholder. See definition of active shareholders in

Column J: Enter salaries, wages, and director fees that are

the Part 3 instructions. For the purposes of determining

attributable to each shareholder or C Corporation officer.

disqualification for the Small Business Alternative Credit, an

Compensation paid by a professional employer organization to

active shareholder’s share of business income is not attributed

the officers of a client (if the client is a C Corporation) and to

to another active shareholder.

employees of the professional employer organization who are

exAmpLe: In this case, the husband and daughter are

assigned or leased to and perform services for a client must be

active shareholders because compensation, director fees, or

included in determining the eligibility of the client for this credit.

dividends from the business are greater than $10,000. The wife

Note: If a shareholder owned stock for less than the entire

and son are not active because compensation, director fees, or

tax year of the corporation, or an officer served as an officer

dividends from the business are less than $10,000.

less than the entire tax year, report only the salaries, wages

and director fees attributable while serving as an officer

Stock Percentage

or shareholder. These amounts must be annualized when

Column E

Column F

Column G

determining disqualifiers, but should be reported as actual

Husband

100%

70%

amounts on this form.

40%

(active)

(all shareholders)

(husband/wife/son)

Note: All compensation must be included, whether or not the

Wife

100%

100%

shareholder or C Corporation officer worked in Michigan.

10%

(inactive)

(all shareholders)

(all shareholders)

Column K: Enter employee insurance payments and pensions

Son

70% (husband/

70%

20%

that are attributable to each shareholder or C Corporation officer.

(inactive)

wife/son)

(husband/wife/son)

Note: If a shareholder owned stock for less than the entire tax

Daughter

80% (husband/

40%

30%

(active)

wife/daughter)

(wife/daughter)

year of the corporation, or an officer served as an officer less

than the entire tax year, report only the employee insurance

Column I: Enter total dividends received by each shareholder

payments, and pensions that are attributable while serving as

an officer or shareholder. These amounts must be annualized

during the tax year from this business (used to determine active

when determining disqualifiers, but should be reported as actual

shareholders). This includes regular distributions for an S

Corporation.

amounts on this form.

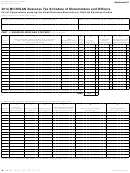

ATTRIBUTION ExAMPLE:

Larry David Stone

Husband of Betty Stone, Father of Mary Stone, Stepfather of Tammie Rock, Step Grandfather of Kathy Rock

Betty Ann Stone

Daughter of Bob Pebble, Wife of Larry Stone, Mother of Tammie Rock, Stepmother of Mary Stone, Grandmother of Kathy Rock

Mary Elizabeth Stone

Daughter of Larry Stone, Stepdaughter of Betty Stone

Daughter of Betty Stone, Stepdaughter of Larry Stone, Spouse of Steve Rock, Mother of Kathy Rock, Granddaughter of

Tammie Marie Rock

Bob Pebble

Steve Carl Rock

Spouse of Tammie Rock, Father of Kathy Rock, Brother of Mike Rock

Kathy Evelyn Rock

Daughter of Tammie and Steve Rock, Granddaughter of Betty Stone, Step Granddaughter of Larry Stone

Mike Joseph Rock

Brother of Steve Rock

Bob Kenneth Pebble

Father of Betty Stone, Grandfather of Tammie Rock

Terry Robert Marble

Friend

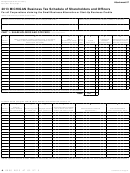

Part 1: Shareholders and officers - See instructions

Part 2: List of family members and their corresponding relationships

1.

A

B

2.

O

P

Q

R

S

T

Name of shareholder (including corporation, trust,

Check (X) if

or partnership), officer, or family member receiving

Member

Member

No Attributable

Number

compensation from the business (Last, First, Middle)

Number

Spouse

Parent

Child

Grandchild

Relationship

Stone, Larry David

1

1

2

3

Stone, Betty Ann

2

2

1

8

4

6

Stone, Mary Elizabeth

3

3

1

4

Rock, Tammie Marie

4

5

2

6

Rock, Steve Carl

5

5

4

6

Rock, Kathy Evelyn

6

6

4-5

7

Rock, Mike Joseph

7

X

Pebble, Bob Kenneth

8

8

2

4

Marble, Terry Robert

9

9

X

100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5