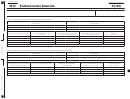

Schedule H-2 - Recapture Offset Worksheet - 2012 Page 3

ADVERTISEMENT

Schedule H-2 Worksheet Instructions

A taxpayer who has taken an Investment Tax Credit on property which

less than twice the minimum tax, credits allowed for use in that year

has ceased to be in qualified use before the end of its useful life must

are equal to the excise minus the minimum tax. Starting with the

pay a recapture tax on that portion of unused credit. To calculate the

Economic Opportunity Area Credits and working downward through

recapture tax, the taxpayer must complete and file Schedule H-2,

col. a, transfer credits available for use into col. b until the total col. b

Credit Recapture. Under Massachusetts law, an offset of the recapture

credits equal the amount of credits allowable for use in that year or all

tax is allowed for credits that have lapsed or are currently in carry over

available credits are used, whichever occurs first.

balances. The Recapture Offset Worksheet substantiates that any off-

Columns c and d. To complete col. d, the taxpayer must know how

set taken against the recapture tax is a result of credits which directly

many credits could not be use in that tax year because of the rule

relate to the recapture property.

that only 50% of the excise may be offset by credits. This rule applies

The Recapture Offset Worksheet’s sole function is to calculate what

to tax years beginning on or after January 1, 1983. The amount of

portion, if any, of the recapture property’s original Investment Tax

credits eligible for conversion to unlimited carryover status is equal to

Credit has never been used to offset the corporate excise in any tax

50% of the excise. (For example, when a corporation has a corporate

year. This portion of the original Investment Tax Credit is allowed as

excise before credits of $1,000, only $500 of credits can be used in

an offset since it will have yielded no tax benefit and therefore should

that tax year. Therefore, $500 is the maximum amount of credits eligi-

not incur a recapture tax. The worksheet provides a method of “track-

ble for conversion to unlimited carryover status.)

ing” exactly how many credits which relate to the recapture property

Working downward from col. c, transfer unused credits to col. d.

have been used, lapsed or are currently in carryover balances. In ad-

Convert the unused credits to unlimited status until all unused credits

dition, if an offset of the recapture tax is due to unused credits in cur-

are transferred or the total col. d credits equal the amount of the cred-

rent carryover balances, the carryover balances must be reduced by

its eligible for conversion to unlimited carryover status, whichever

that offset amount in order to prevent future use of these credits.

occurs first. Note: lines 10c, 21c, 32c and 43c automatically transfer

To complete the Schedule H-2 Recapture Offset Worksheet, follow

to col. d since they are unlimited credit carryovers from prior years.

the instructions below.

Column e. Subtract col. d from col. c and enter the result in col. e,

Part 1. Use Part 1 to calculate how much of the recapture property’s

except for shaded areas.

original credit was actually used during the first four tax years of its

Part 2. This section calculates what portion, if any, of unlimited carry-

qualified use. Starting with the tax year the recapture property was

overs already used is attributable to the recapture property.

placed in service, Part 1 tracks the credits related to the recapture

property through the first four years. The detailed tracking of credits

Taxpayers must look to their own records to determine how many

in Part 1 is necessary to determine what portions of 3-year carryovers

unlimited carryovers were actually used to offset tax during the

have been used, converted to unlimited status or have lapsed.

period of Year 5 through the year of recapture.

Column a. Year 1 was the tax year the recapture property was

Part 3. Part 3 determines what portion of the recapture property’s orig-

placed in service. For lines 1 through 10 in col. a, enter the beginning

inal Investment Tax Credit was never used to offset tax.

balances for each respective credit category. Enter in line 11, col. a

Part 4. If the recapture tax is reduced by credits that were never used,

the total Investment Tax Credits from property placed in service in

then an adjustment may be necessary to the taxpayer’s current carry-

year 1, including credits from the recapture property.

over balances.

Column b. To complete col. b, the taxpayer must know how many

If the reduction of the tentative recapture tax is due to unused credits

credits were allowed for use in that year. For tax years beginning on

in current carryover balances, the carryover balances must be re-

or after January 1, 1983, only 50% of the corporate excise (before

duced by the “reduction amount.” Taxpayers will not be allowed to

credits) may be offset by credits. In addition, credits cannot reduce

use credit carryovers to reduce the recapture tax and to offset tax in

the excise below the minimum tax. When the corporate excise is

future years.

equal to, or greater than, twice the minimum tax, credits allowed for

use in that year are 50% of the excise. When the corporate excise is

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3