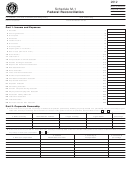

Schedule Nir - Net Income Reconciliation - 2012 Page 2

ADVERTISEMENT

Schedule NIR Instructions

General Information

Line 5a. Enter the entity’s Federal Identification number. If the entity

does not have one, enter zeros.

What Is the Net Income Reconciliation?

Schedule Net Income Reconciliation (NIR) reconciles income reported

Line 5b. Enter the code corresponding to the type of entity for U.S. tax

to shareholders with the income reported on the taxpayer’s consoli-

purposes using the entity type chart.

dated U.S. tax return and is similar to U.S. Schedule M-3, Part 1.

Line 5c. If the entity files an income tax return of any kind in Massachu-

Taxpayers must file Schedule NIR if required to file a U.S. Schedule M-3

setts, enter “Y”. If no return is filed in Massachusetts, enter “N.”

with their U.S. tax return, including corporations that are part of a consoli-

Line 5d. Enter “1” if this is a non-includible foreign entity with net in-

dated return that includes U.S. Schedule M-3. Corporations included in a

come greater than zero. Enter “2” if this is a non-includible foreign entity

Massachusetts combined group submit Schedule NIR with Form 355U.

with net income of zero or less than zero.

Multiple Schedules NIR are required only where a Massachusetts com-

bined group includes corporations that separately submit U.S. Sched-

Line 5e. Enter, as a negative amount, the amount of income excluded

ules M-3 with separate U.S. tax returns.

from the U.S. return due to the exclusion of this entity. Losses excluded

from the U.S. return are entered as positive amounts. The total of all

Line Instructions

entries on Schedule NIR line 5e should equal the total of the U.S.

Schedule M-3, part 1, lines 5a and 5b.

Registration Section. Enter the name and Federal Identification number

Line 6. Enter individually the name of each separate domestic entity

of the entity submitting Schedule NIR on the top line. On the 2nd line,

enter the name and Federal Identification number as it appears on U.S.

whose income is included in the worldwide income shown on line 4 but

Schedule M-3 as filed. This may be a corporation that does not have a

not included on the federal tax return. These will be the same entities

requirement to file a return in Massachusetts. If applicable, enter the

identified in the required schedules reconciling the entries on U.S.

Schedule M-3, part 1, lines 6a and 6b.

same information which was entered in line 1. Do not leave line 2 blank.

Line 6a. Enter the entity’s Federal Identification number. If the entity

Lines 1 through 3. Complete lines 1 through 3 using information from

does not have one, enter zeros.

U.S. Schedule M-3, Part 1.

Line 6b. Enter the code corresponding to the type of entity for federal

Line 4. Enter in line 4 the consolidated worldwide income exactly as

shown on U.S. Schedule M-3, Part 1, line 4.

tax purposes. Use the same entity type codes provided for line 5b.

Line 6c. If the entity files a return in Massachusetts, enter “Y.” If not,

Lines 5 through 7. List individually the different entities, included or ex-

cluded in converting the consolidated worldwide income on line 4 to the

enter “N.”

net income per income statement figure reported on U.S. Schedule M-

Line 6d. Enter “3” if this is a non-includible domestic entity with net in-

3, Part 1, line 11. Each entity must be identified by name, Federal Iden-

come greater than zero. Enter “4” if this is a non-includible domestic en-

tification number (if applicable), and entity type using the following

tity with net income of zero or less than zero.

table:

Line 6e. Enter, as a negative amount, the amount of income excluded

Entity Type Codes for Column b

from the U.S. return due to the exclusion of this entity. Losses excluded

01: Corporations exempt from taxation under section 501 and not in-

from the U.S. return are entered as positive amounts. The total of all

cluded in a U.S. consolidated income tax return.

entries on Schedule NIR line 6e should equal the total of the U.S.

Schedule M-3, Part 1, lines 6a and 6b.

02: Insurance companies subject to tax under section 801 and not in-

cluded in a U.S. consolidated income tax return.

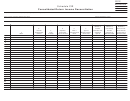

Line 7. Enter individually the names of each separate entity whose in-

come or loss is not included in the worldwide income shown on line 4

03: Foreign corporations not included in a U.S. consolidated income tax

but which is included on the federal tax return. These will be the same

return.

entities identified in the required schedules reconciling the entries on

04: Corporations with respect to which and election under section 936

U.S. Schedule M-3. Part 1, lines 7a and 7b.

(relating to possession tax credit) is in effect for the taxable year.

Line 7a. Enter the entity’s Federal Identification number. If the entity

05: Regulated Investment Company subject to tax under subchapter M

does not have one, enter zeros.

06: Real Estate Investment Trust subject to tax under subchapter M

Line 7b. Enter the code corresponding to the type of entity for U.S. tax

purposes. Use the same entity type codes provided above.

07: A DISC as defined in section 992(a)(1)).

Line 7c. No entries should be entered in this column.

21: A U.S. domestic corporation, whether included or excluded in the

U.S. return, where code numbers 01 through 07 do not apply.

Line 7d. Enter “5” if this is an “other includible entity” with net income

greater than zero. Enter “6” if this is an “other includible entity” with net

22: A U.S. domestic limited liability company, whether included or ex-

income of zero or less than zero.

cluded in the U.S. return, where code numbers 01 through 07 do not

Line 7e. Enter, as a positive amount, the amount of income attributable

apply.

to the entity being added to worldwide consolidated income for the tax

23: A U.S. domestic entity which is not a corporation or a limited liability

return. Enter all losses as negative numbers. This differs from the fed-

company, whether included or excluded in the U.S. return, where code

eral instructions.

numbers 01 through 07 do not apply.

Line 8. Enter the total amount of the adjustment to eliminations of trans-

31: A foreign entity, whether included or excluded in the U.S. return,

actions between includible entities and non-includible entities. This is

where code numbers 01 through 07 do not apply.

the amount shown on U.S. Schedule M-3, Part 1, line 8.

Line 5. Enter individually the name of each separate foreign entity

Line 9. Enter the total amount of any adjustment to reconcile the in-

whose income is included in the worldwide income shown on line 4 but

come statement period to the tax year. This is the amount shown on

not included on the U.S. tax return. These will be the same entities

U.S. Schedule M-3, Part 1, line 9.

identified in the required schedules reconciling the entries on U.S.

Schedule M-3, Part 1, lines 5a and 5b.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3