Instructions For Schedule Cir- Consolidated Return Income Reconciliation - 2012 Page 2

ADVERTISEMENT

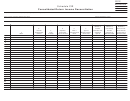

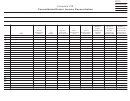

Column e

Enter "Y" if a Massachusetts tax return is being filed by this entity.

Enter “N” if a Massachusetts tax return is not being filed by this entity.

Column f

Enter the three-digit numeric code that identifies the type of Massachusetts tax return being

filed. Corporations filing both Form 355U and any other return must use the code for Form

355U. If not filing Form 355U, do not complete columns g, h or i.

007: Form 3, Partnership Return

350: Form 355SC, Domestic or Foreign Security Corporation Return

346: Form 355U, Massachusetts Combined Reporting

374: Form 63-29A, Ocean Marine Profits tax return

375: Form 63FI, Financial Institution Excise tax return

385: Form PS-1, Public Service Corporation Franchise tax return

386: Form 63-20P, Premium Excise Return for Insurance Companies

387: Form 63-23P, Premium Excise return for Life Insurance Companies

397: Form 355, Massachusetts Business or Manufacturing Corporation Excise Return

997: Other

000: No Massachusetts return is being filed for this tax year

Column g

Enter the amount of a member’s income excluded from the combined report from Schedule

U-M, line 28, column d.

Column h

Enter the amount of a member’s non-unitary income allocated to Massachusetts .From

Schedule U-ST, combine lines 12, 17 and 22 to obtain this amount.

Column i

Enter the member’s share of combined income apportioned to Massachusetts. From Schedule

U-ST, combine lines 11, 16 and 21 to obtain this amount.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2