Service

Canada

Estimate Request for Canada Pension Plan

Retirement Pension and Post-Retirement Benefit

You may also visit the Service Canada website at

servicecanada.gc.ca/calculator to use

the online retirement calculator to estimate

your Canada Pension Plan retirement pension

and post-retirement benefits.

This request form is to obtain an estimate of your Canada Pension Plan (CPP)

retirement pension or of your Post-Retirement Benefit, or both. The following information

is intended to help you complete sections 5 and 8.

Section 5

When you request an estimate of your Canada Pension Plan retirement pension,

we automatically calculate the amount you will receive at age 65 when you become

entitled to your full pension. However, you can receive a reduced pension as early as

age 60 or begin receiving an increased pension after age 65 up to age 70. You can

choose any three retirement ages between 40 and 70 for which you would like

estimates.

NOTE:

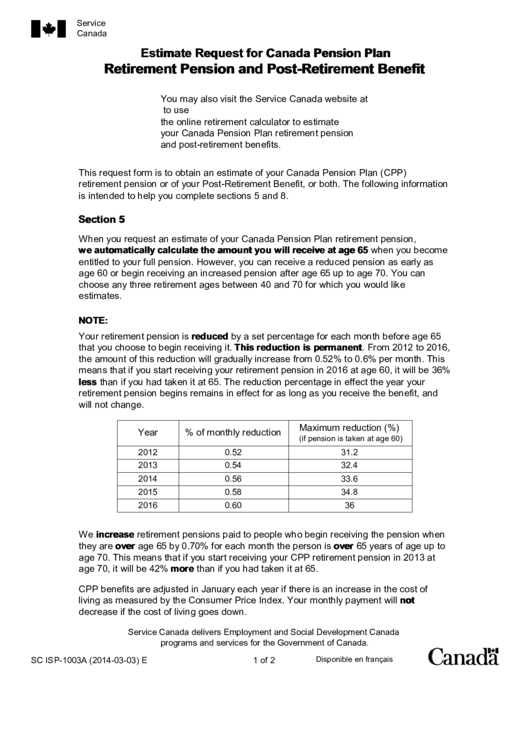

Your retirement pension is reduced by a set percentage for each month before age 65

that you choose to begin receiving it. This reduction is permanent. From 2012 to 2016,

the amount of this reduction will gradually increase from 0.52% to 0.6% per month. This

means that if you start receiving your retirement pension in 2016 at age 60, it will be 36%

less than if you had taken it at 65. The reduction percentage in effect the year your

retirement pension begins remains in effect for as long as you receive the benefit, and

will not change.

Maximum reduction (%)

Year

% of monthly reduction

(if pension is taken at age 60)

2012

0.52

31.2

2013

0.54

32.4

2014

0.56

33.6

2015

0.58

34.8

2016

0.60

36

We increase retirement pensions paid to people who begin receiving the pension when

they are over age 65 by 0.70% for each month the person is over 65 years of age up to

age 70. This means that if you start receiving your CPP retirement pension in 2013 at

age 70, it will be 42% more than if you had taken it at 65.

CPP benefits are adjusted in January each year if there is an increase in the cost of

living as measured by the Consumer Price Index. Your monthly payment will not

decrease if the cost of living goes down.

Service Canada delivers Employment and Social Development Canada

programs and services for the Government of Canada.

Disponible en français

SC ISP-1003A (2014-03-03) E

1 of 2

1

1 2

2 3

3 4

4 5

5