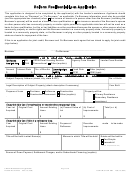

PROTECTED B (when completed)

SIN

(Refer to Section 8 of the information sheet to help you complete this section.)

8. I would like an estimate of my Canada Pension Plan (CPP) Post-Retirement Benefit.

If I work or plan to return to work while receiving my CPP retirement pension.

When I am aged 60 to 65 years old.

(Contributions to the CPP Post-Retirement Benefit are mandatory for you and your employer if you are working while

receiving your CPP retirement pension.)

What will my estimated Post-Retirement Benefit be based on my

Estimated annual

In year

estimated annual earnings?

earnings

$

Estimate 1

Estimate 2

$

Estimate 3

$

When I am aged 65 to 70 years old.

(You and your employer continue to make CPP contributions unless you choose not to contribute. The choice to make

contributions or not can only be made once per calendar year. At age 70, you will stop contributing.)

Note: Estimated earnings (For each estimate requested below, enter the amount of your estimated earnings based on

one or any combination of these scenarios. Only one scenario can apply to each estimate.)

- Estimated annual earnings for the year where you work and contribute all year, OR

- Estimated earnings in that year for the period up to the month you plan to stop contributing, OR

- Estimated earnings in that year for the period after the month you plan to start contributing again.

If you do not plan to contribute all year

What will my estimated Post-

I plan

Estimated earnings

Month I plan to

Month I plan to start

Retirement Benefit be based

In year

to contribute

or

(see note above)

stop contributing

contributing again

on my estimated earnings?

all year

Estimate 1

$

Yes

No

Estimate 2

$

Yes

No

Estimate 3

$

Yes

No

Privacy Notice Statement

The information you provide is collected under the authority of the Canada Pension Plan legislation and will be used to

estimate the amount of your Canada Pension Plan (CPP) Retirement benefit and Post-Retirement Benefit. This is not

an application for a CPP benefit. The Social Insurance Number (SIN) is collected under the authority of section 52 of

the Canada Pension Plan Regulations, and in accordance with Treasury Board Secretariat Directive on the SIN as an

authorized user of the SIN. The SIN will be used to ensure an individual's exact identification so that contributory

earnings can be correctly posted allowing for benefits and entitlements to be accurately calculated.

Submitting this request for an estimate is voluntary. However, if you refuse to provide your personal information, the

Department of Employment and Social Development Canada (ESDC) will be unable to provide you with an estimate of

your CPP Retirement benefit.

The information you provide may be used and/or disclosed for policy analysis, research and/or evaluation purposes. In

order to conduct these activities, various sources of information under the custody and control of ESDC may be linked.

However, these additional uses and/or disclosures of your personal information will never result in an administrative

decision being made about you (such as a decision on your entitlement to a benefit).

Your personal information is administered in accordance with the Department of Employment and Social Development

Act, Canada Pension Plan and the Privacy Act. You have the right of access to, and to the protection of, your personal

information. It will be kept in Personal Information Bank ESDC PPU 146. Instructions for obtaining this information are

outlined in the government publication entitled Info Source, which is available at the following Web site address:

infosource.gc.ca. Info Source may also be accessed online at any Service Canada Centre.

Signature

Date

(YYYY-MM-DD)

X

SC ISP-1003 (2014-03-03) E

2 of 2

1

1 2

2 3

3 4

4 5

5