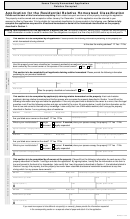

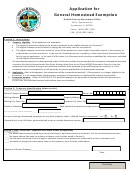

Application For Residential Homestead Exemption For Page 2

ADVERTISEMENT

[ ] Place an "X" or check mark in the box if the ownership interest(s) identified above is less than 100 percent (100%) in the property for which you are claiming a residence

homestead exemption. Provide on a separate sheet the following information for each additional person who has an ownership interest in the property: property owner's

name; birth date; driver's license, personal ID certificate, or social security number; primary phone number; email address; and percentage (%) of ownership interest in the

property.

Applicant's mailing address (if different from the physical address of the principal residence provided above):

__________________________________________________________________________________________

If the ownership of your property is in stock in a cooperative housing corporation, do you have an exclusive right to occupy the unit at the physical address identified above?

………………………….................................................................................................………….. Yes [ ] No [ ]

Is any portion of the property for which you are claiming a residence homestead exemption income producing? .....Yes [ ] No [ ]

If you answered "Yes," please indicate the percentage of the property that is income producing: ___ %

* Under Tax Code Section 11.43(m), a person who receives a general residence homestead exemption in a tax year is entitled to receive the age 65 or older exemption in the

next tax year on the same property without applying for it, if the person becomes 65 years old in that next year as shown by certain information in the appraisal district

records or information the Texas Department of Public Safety provided to the appraisal district under Section 521.049 of the Transportation Code.

** Disclosure of your social security number (SSN) may be required and is authorized by law for the purpose of tax administration and identification of any individual

affected by applicable law. Authority: 42 U.S.C. § 405(c)(2)(C)(i); Tax Code § 11.43(f). Except as authorized by Tax Code Section 11.48(b), a driver's license number,

personal identification certificate number, or social security number provided in this application for an exemption filed with your county appraisal district is confidential and

not open to public inspection under Tax Code Section 11.48(a).

*** An email address of a member of the public could be confidential under Government Code Section 552.137; however, by including the email address on this form, you

are affirmatively consenting to its release under the Public Information Act.

Step 4: Exemption Transfer

Place an "x" or check mark beside the type of surviving spouse exemption transfer you seek from your previous residence homestead:

[ ] 100% Disabled Veteran's Exemption (Tax Code Section 11.131(d))

Address of last residence homestead

[ ] Donated Residence Homestead of Partially Disabled Veteran (Tax Code Section 11.132(d))

[ ] Member of Armed Forces Killed in Action (Tax Code Section 11.133(c))

___________________________________________

___________________________________________

Step 5: Application Documents

Attach a copy of your driver's license or state-issued personal identification certificate. The address listed on your driver's license or state-issued personal

identification certificate must correspond to the address of the property for which an exemption is claimed in this application. In certain cases, you are exempt

from these requirements or the chief appraiser may waive the requirements.

ALSO SEE INSTRUCTIONS AND OTHER IMPORTANT INFORMATION FOLLOWING THE APPLICATION

Please indicate if you are exempt from the requirement to provide a copy of your driver's license or state-issued personal identification certificate:

I am a resident of a facility that provides services related to health, infirmity, or aging.

[ ]

Name and Address of Facility_______________________________________________________________________

I am certified for participation in the address confidentiality program administered by the Office of the Texas Attorney General under Subchapter C, Chapter 56,

[ ]

Code of Criminal Procedure.

Please indicate if you request that the chief appraiser waive the requirement that the address of the property for which the exemption is claimed corresponds to the

address listed on your driver's license or state-issued personal identification certificate:

I am an active duty member of the armed services of the United States or the spouse of an active duty member. Attached are a copy of my military identification card

[ ]

or that of my spouse and a copy of a utility bill for the property subject to the claimed exemption in my name or my spouse's name.

I hold a driver's license issued under §521.121 or §521.1211, Transportation Code. Attached is a copy of the application for that license from the Texas Department

[ ]

of Transportation.

for an AGE 65 OR OLDER OR DISABLED exemption:

In addition to the information identified above, an applicant for an age 65 or older or disabled exemption who is not specifically identified on a deed or other instrument

recorded in the applicable real property records as an owner of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s

ownership of an interest in the homestead.

for a 100% DISABLED VETERANS exemption:

In addition to the information identified above, an applicant for a 100% disabled veterans exemption or the surviving spouse of a disabled veteran who qualified for the

100% disabled veteran's exemption must provide documentation from the United States Department of Veterans Affairs or its successor indicating that the veteran received

100 percent disability compensation due to a service-connected disability and had a rating of 100 percent disabled or individual unemployability.

for MANUFACTURED HOMES:

For a manufactured home to qualify for a residence homestead, applicant must ALSO include:

1) a copy of the statement of ownership and location for the manufactured home issued by the Texas Department of Housing and Community

Affairs showing that the applicant is the owner of the manufactured home;

2) a copy of the purchase contract or payment receipt showing that the applicant is the purchaser of the manufactured; or

3) a sworn affidavit by the applicant indicating that:

a) the applicant is the owner of the manufactured home;

b) the seller of the manufactured home did not provide the applicant with a purchase contract; and

c) the applicant could not locate the seller after making a good faith effort.

Page 2 of 4

Form TA-114 11-15/27

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4