Application For Residential Homestead Exemption For Page 3

ADVERTISEMENT

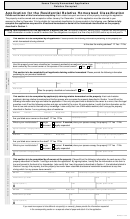

Step 6: Affirmation and Signature

NOTICE REGARDING PENALTIES FOR MAKING OR FILING AN APPLICATION CONTAINING A FALSE STATEMENT: If you make a false

statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal Code.

I,____________________________________________________________________ , swear or affirm to the following:

(Printed Name of Property Owner)

(1) that each fact contained in this application is true and correct; (2) that I meet the qualifications under Texas law for the residence homestead exemption for which I am

applying; (3) that I do not claim an exemption on another residence homestead in Texas or claim a residence homestead exemption on a residence homestead outside

Texas; and (4) that I have read and understand the Notice Regarding Penalties for Making or Filing an Application Containing a False Statement."

Sign Here: _____________________________________________ Date: ______________________

Signature of Property Owner/Applicant or Person Authorized to Sign the Application

(Only a person with a valid power of attorney or court-ordered designation is authorized to sign the application on behalf of the property owner.)

The following table lists each taxing jurisdiction that offers residential homestead exemptions:

STATE MANDATED

LOCAL OPTION

STATE MANDATED

LOCAL OPTION

STATE MANDATED

JURISDICTION

HOMESTEAD

HOMESTEAD

OVER 65 HS

OVER 65 HS

DISABILITY

HUBBARD ISD

25,000

10,000

10,000

LATERAL ROAD

3,000

10,000

HILL COUNTY

10,000

CITY OF HILLSBORO

10,000

HILLSBORO ISD

25,000

10,000

10,000

MT CALM ISD

25,000

10,000

10,000

BLUM ISD

25,000

10,000

10,000

AXTELL ISD

25,000

10,000

10,000

BYNUM ISD

25,000

10,000

10,000

WEST ISD

25,000

10,000

10,000

COVINGTON ISD

25,000

10,000

10,000

MILFORD ISD

25,000

10,000

10,000

GRANDVIEW ISD

25,000

10,000

10,000

FROST ISD

25,000

10,000

10,000

AQUILLA ISD

25,000

10,000

10,000

ABBOTT ISD

25,000

10,000

10,000

ITASCA ISD

25,000

10,000

10,000

MALONE ISD

25,000

10,000

10,000

PENELOPE ISD

25,000

10,000

10,000

WHITNEY ISD

25,000

10,000

5,000

10,000

DAWSON ISD

25,000

10,000

10,000

RIO VISTA ISD

25,000

10,000

10,000

HILL COUNTY ESD #1

10,000

HILL COLLEGE RIO VISTA

0

1%

10,000

HILL COLLEGE GRANDVIEW

0

1%

10,000

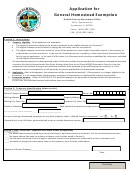

APPLICATION FOR RESIDENTIAL HOMESTEAD EXEMPTION INSTRUCTIONS

GENERAL INSTRUCTIONS: This application is for use in claiming general homestead exemptions pursuant to Tax Code Sections 11.13, 11.131, 11.132, 11.133, and 11.432.

property that you own and occupy as your principal place of residence.

The exemptions apply only to

This document, and all supporting documentation, must be filed with the appraisal district in the county in which your property is located.

WHERE TO FILE:

You are to file the completed application with all required documentation beginning Jan. 1 and no later than April 30 of the year

APPLICATION DEADLINES:

for which you are requesting an exemption. If you qualify for the age 65 or older or disabled persons exemption or the exemption for donated homesteads of

partially disabled veterans, you are to apply for the exemption no later than the first anniversary of the date you qualify for the exemption.

Pursuant to Tax Code Section 11.431, you may file a late application for a residence homestead exemption, including an exemption under Tax Code Sections 11.131, 11.132, and

11.133, after the deadline for filing has passed if it is filed not later than one year after the delinquency date for the taxes on the homestead.

DUTY TO NOTIFY: If the chief appraiser grants the exemption(s), you do not need to reapply annually. You must reapply if the chief appraiser requires you do to so, or if you

want the exemption to apply to property not listed in this application. You must notify the chief appraiser in writing if and when your right to this exemption ends.

OTHER IMPORTANT INFORMATION

Pursuant to Tax Code §11.45, after considering this application and all relevant information, the chief appraiser may request additional information from you. You must provide the

additional information within 30 days of the request or the application is denied. For good cause shown, the chief appraiser may extend the deadline for furnishing the additional

information by written order for a single period not to exceed 15 days.

Page 3 of 4

Form TA-114 11-15/27

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4