Real Estate Transfer Return

ADVERTISEMENT

*R15099990*

STAPLE

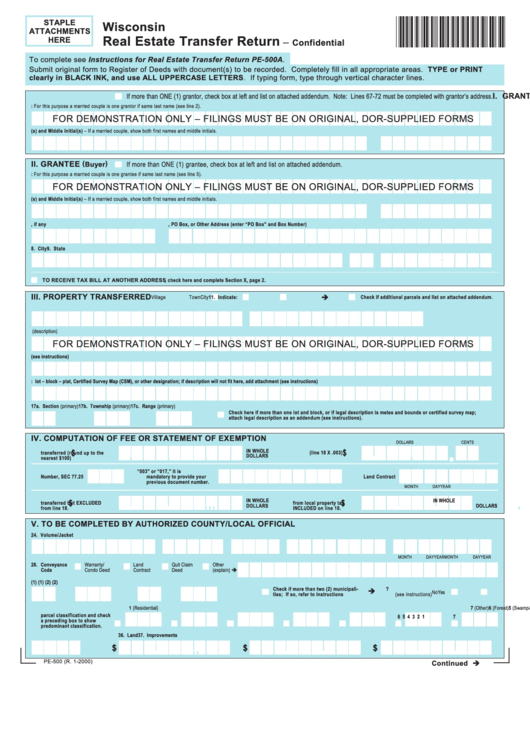

Wisconsin

ATTACHMENTS

Real Estate Transfer Return

HERE

–

Confidential

To complete see Instructions for Real Estate Transfer Return PE-500A.

Submit original form to Register of Deeds with document(s) to be recorded. Completely fill in all appropriate areas. TYPE or PRINT

clearly in BLACK INK, and use ALL UPPERCASE LETTERS. If typing form, type through vertical character lines.

I. GRANTOR

( Seller )

If more than ONE (1) grantor, check box at left and list on attached addendum. Note: Lines 67-72 must be completed with grantor’s address.

1. Your Last Name or Company Name

Note: For this purpose a married couple is one grantor if same last name (see line 2).

FOR DEMONSTRATION ONLY – FILINGS MUST BE ON ORIGINAL, DOR-SUPPLIED FORMS

2. Your First Name(s) and Middle Initial(s) – If a married couple, show both first names and middle initials.

3. Social Security Number or FEIN

II. GRANTEE

( Buyer )

If more than ONE (1) grantee, check box at left and list on attached addendum.

4. Your Last Name or Company Name

Note: For this purpose a married couple is one grantee if same last name (see line 5).

FOR DEMONSTRATION ONLY – FILINGS MUST BE ON ORIGINAL, DOR-SUPPLIED FORMS

5. Your First Name(s) and Middle Initial(s) – If a married couple, show both first names and middle initials.

6. Social Security Number or FEIN

7. Street or Fire Number, if any

7a. Street Name, PO Box, or Other Address (enter “PO Box” and Box Number)

8. City

9. State

10. Zip Code

TO RECEIVE TAX BILL AT ANOTHER ADDRESS, check here and complete Section X, page 2.

III. PROPERTY TRANSFERRED

è

11. Indicate:

City

Village

Town

Check if additional parcels and list on attached addendum.

12. Name of the City/ Village/ Town

13. County Name

14. Physical Property Address or Road Address (description)

FOR DEMONSTRATION ONLY – FILINGS MUST BE ON ORIGINAL, DOR-SUPPLIED FORMS

15. Tax Parcel Number as it appears on Property Tax bill (see instructions)

16. Property Description: lot – block – plat, Certified Survey Map (CSM), or other designation; if description will not fit here, add attachment (see instructions)

17a. Section (primary)

17b. Township (primary)

17c. Range (primary)

Check here if more than one lot and block, or if legal description is metes and bounds or certified survey map;

attach legal description as an addendum (see instructions).

IV. COMPUTATION OF FEE OR STATEMENT OF EXEMPTION

DOLLARS

CENTS

18. Total value of REAL ESTATE

19. Transfer fee due

,

,

,

,

,

$

IN WHOLE

$

transferred (round up to the

(line 18 X .003)

DOLLARS

nearest $100)

20. Transfer Exemption

20a. If you enter “003” or “017,” it is

20b. Date of Original

Number, SEC 77.25

mandatory to provide your

Land Contract

previous document number.

MONTH

DAY

YEAR

21. Value of personal property

22. Value of property exempt

,

,

,

,

,

IN WHOLE

IN WHOLE

$

$

transferred but EXCLUDED

from local property tax

DOLLARS

DOLLARS

from line 18.

INCLUDED on line 18.

V. TO BE COMPLETED BY AUTHORIZED COUNTY/LOCAL OFFICIAL

23. Document Number

24. Volume/Jacket

25. Page/Image

26. Date Recorded

27. Date of Conveyance

MONTH

DAY

YEAR

MONTH

DAY

YEAR

28. Conveyance

Warranty/

Land

Quit Claim

Other

Code

Condo Deed

Contract

Deed

(explain) è

29. County (1)

30. Municipality (1)

31. County (2)

32. Municipality (2)

Check if more than two (2) municipali-

33. Is this a split parcel?

è

Yes

No

ties; If so, refer to instructions

(see instructions)

1 (Residential)

2 (Commercial)

3 (Manufacturing)

4 (Agricultural)

5 (Swamp&Waste)

6 (Forest)

7 (Other)

34. Enter number of acres for each

parcel classification and check

1

2

3

4

5

6

7

a preceding box to show

predominant classification.

35. Assessment Year

36. Land

37. Improvements

38. Total Assessment

,

,

,

,

,

,

$

$

$

PE-500 (R. 1-2000)

Continued è

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2