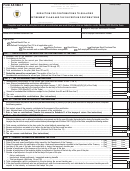

DIRECTIONS FOR THE

PERA TAX DEDUCTION FORM

Anytime a PERA pension recipient needs to change their tax withholding information with PERA,

they must complete this form. The pension recipient must complete the top portion of the form with

their personal information.

The first box indicates you do not want United States federal income tax withheld from your PERA

pension payment.

The second box indicates you do not want New Mexico State income taxes withheld from your

PERA pension payment. If you move outside the state of New Mexico, you should complete a new

PERA Tax Deduction Form and check this box. PERA can only pay New Mexico state income tax.

If you move to a state that has an income tax, you must pay this income tax on your own.

The third box indicates you want PERA to withhold state and federal income taxes based on a

specific number of exemptions at either the married or single rate. The more exemptions you claim

will lower the amount the taxes that will be withheld from your check. PERA uses the most current

state and federal tax rates. These rates generally change as of January 1 of each year. Even if

you do not change your tax withholdings, the amount withheld from your pension payment might

change due to a change in the tax rate.

Indicate on the line Total Exemptions Claimed the number of exemptions you want your

withholdings calculated.

The fourth box tells PERA that in additional to the taxes being withheld based on a specific number

of exceptions, you wish to have an additional amount withheld. Indicate the additional amount you

want for federal taxes and/or state taxes.

The fifth box tells PERA that you want an exact amount withheld for your taxes. This amount will

not change even if the tax rate changes.

1

1 2

2