Resort Tax Return Form - City Of Miami Beach

ADVERTISEMENT

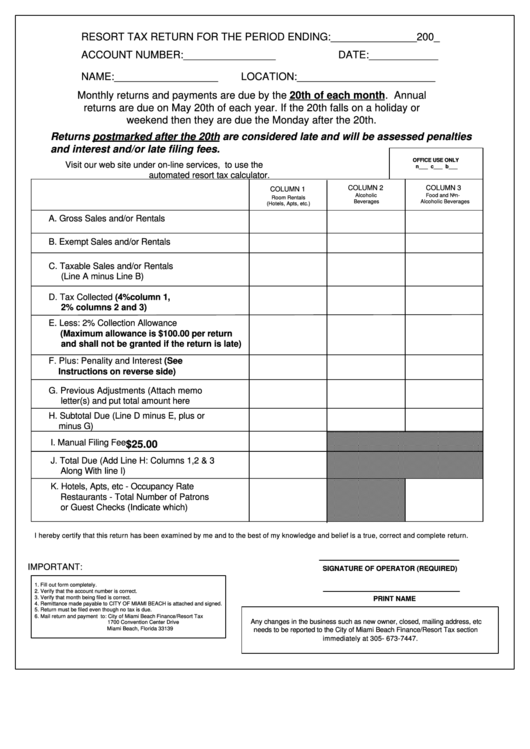

RESORT TAX RETURN FOR THE PERIOD ENDING:_______________200_

ACCOUNT NUMBER:________________

DATE:____________

NAME:__________________

LOCATION:________________________

Monthly returns and payments are due by the 20th of each month. Annual

returns are due on May 20th of each year. If the 20th falls on a holiday or

weekend then they are due the Monday after the 20th.

Returns postmarked after the 20th are considered late and will be assessed penalties

and interest and/or late filing fees.

OFFICE USE ONLY

Visit our web site under on-line services, to use the

n___ c___ b___

automated resort tax calculator.

COLUMN 2

COLUMN 3

COLUMN 1

Alcoholic

Food and Non-

Room Rentals

Beverages

Alcoholic Beverages

(Hotels, Apts, etc.)

A. Gross Sales and/or Rentals

B. Exempt Sales and/or Rentals

C. Taxable Sales and/or Rentals

(Line A minus Line B)

D. Tax Collected (4%column 1,

2% columns 2 and 3)

E. Less: 2% Collection Allowance

(Maximum allowance is $100.00 per return

and shall not be granted if the return is late)

F. Plus: Penality and Interest (See

Instructions on reverse side)

G. Previous Adjustments (Attach memo

letter(s) and put total amount here

H. Subtotal Due (Line D minus E, plus or

minus G)

I. Manual Filing Fee

$25.00

J. Total Due (Add Line H: Columns 1,2 & 3

Along With Iine I)

K. Hotels, Apts, etc - Occupancy Rate

Restaurants - Total Number of Patrons

or Guest Checks (Indicate which)

I hereby certify that this return has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

IMPORTANT:

SIGNATURE OF OPERATOR (REQUIRED)

1. Fill out form completely.

2. Verify that the account number is correct.

3. Verify that month being filed is correct.

PRINT NAME

4. Remittance made payable to CITY OF MIAMI BEACH is attached and signed.

5. Return must be filed even though no tax is due.

6. Mail return and payment to: City of Miami Beach Finance/Resort Tax

Any changes in the business such as new owner, closed, mailing address, etc

1700 Convention Center Drive

Miami Beach, Florida 33139

needs to be reported to the City of Miami Beach Finance/Resort Tax section

immediately at 305- 673-7447.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1