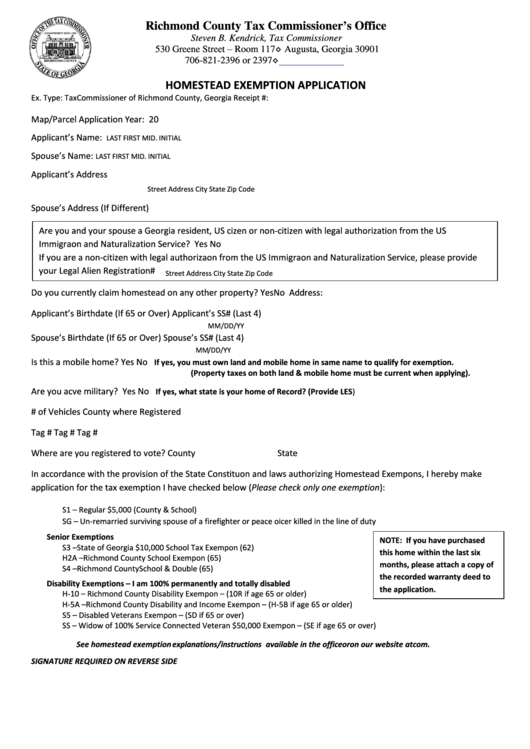

Richmond County Tax Commissioner’s Office

Steven B. Kendrick, Tax Commissioner

530 Greene Street – Room 117◊ Augusta, Georgia 30901

706-821-2396 or 2397◊

HOMESTEAD EXEMPTION APPLICATION

Ex. Type:

Tax Commissioner of Richmond County, Georgia

Receipt #:

Map/Parcel

Application Year: 20

Applicant’s Name:

LAST

FIRST

MID. INITIAL

Spouse’s Name:

LAST

FIRST

MID. INITIAL

Applicant’s Address

Street Address

City

State

Zip Code

Spouse’s Address (If Different)

Are you and your spouse a Georgia resident, US citizen or non-citizen with legal authorization from the US

Immigration and Naturalization Service?

Yes

No

If you are a non-citizen with legal authorization from the US Immigration and Naturalization Service, please provide

your Legal Alien Registration#

Street Address

City

State

Zip Code

Do you currently claim homestead on any other property?

Yes

No Address:

Applicant’s Birthdate (If 65 or Over)

Applicant’s SS# (Last 4)

MM/DD/YY

Spouse’s Birthdate (If 65 or Over)

Spouse’s SS# (Last 4)

MM/DD/YY

Is this a mobile home?

Yes

No

If yes, you must own land and mobile home in same name to qualify for exemption.

(Property taxes on both land & mobile home must be current when applying).

Are you active military?

Yes

No

If yes, what state is your home of Record? (Provide LES)

# of Vehicles

County where Registered

Tag #

Tag #

Tag #

Where are you registered to vote? County

State

In accordance with the provision of the State Constitution and laws authorizing Homestead Exemptions, I hereby make

application for the tax exemption I have checked below (Please check only one exemption):

S1 – Regular $5,000 (County & School)

SG – Un-remarried surviving spouse of a firefighter or peace officer killed in the line of duty

Senior Exemptions

NOTE: If you have purchased

S3 – State of Georgia $10,000 School Tax Exemption (62)

this home within the last six

H2A – Richmond County School Exemption (65)

months, please attach a copy of

S4 – Richmond County School & Double (65)

the recorded warranty deed to

Disability Exemptions – I am 100% permanently and totally disabled

the application.

H-10 – Richmond County Disability Exemption – (10R if age 65 or older)

H-5A –Richmond County Disability and Income Exemption – (H-5B if age 65 or older)

S5 – Disabled Veterans Exemption – (SD if 65 or over)

SS – Widow of 100% Service Connected Veteran $50,000 Exemption – (SE if age 65 or over)

See homestead exemption explanations/instructions available in the office or on our website at .

SIGNATURE REQUIRED ON REVERSE SIDE

1

1 2

2