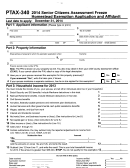

Please complete this income section if applying for S-3 State of Georgia $10,000 School Exemption, S-4

Richmond County Full School & Double Exemption or H-5A Richmond County Disability & Income

Exemption.

A copy of the prior year’s Georgia 500 tax return must accompany your application for the senior/special exemptions. If you are not

required to file a Georgia income tax return, a copy of income information from the Social Security Administration, financial

institutions or your pension plan must accompany your application. If you are applying for a disability exemption, you must also

provide the necessary Physician statement(s). Your application cannot be processed without this information.

It is the duty of the owner to notify the Office of the Tax Commissioner in the event he/she becomes ineligible for an exemption.

For more detailed information or assistance, please contact our homestead representative at 706-821-2396, Monday through

Friday, 8:30 a.m. – 5:00 p.m. Please have your address or map/parcel number available when calling.

INCOME FOR YEAR ENDING DECEMBER 31, 20

(Subject to verification)

Claimant and/or Joint Return

Spouse if Separate Return

1. Retirement Income from Georgia Tax Return

$

$

2. Social Security Income

3. Less maximum allowable retirement income

- 55,742.00

-55,742.00

4.Total

5. Other Income (Rent, Interest, etc.)

6. Less personal exemption amount – GA Tax Return

7. Net income for S-4 Double Exemption or S-3 State School Tax

Exemption (claimant and spouse) must be less than $10,000.

Net taxable income for H-5A Disability & Income Exemption

(Claimant and Spouse) must be less than $20,000.

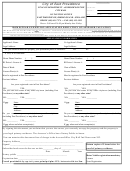

Affidavit of Homestead Exemption:

I, the undersigned, do solemnly swear that the statements made in support of this application are true and correct, and

that I am the bona fide owner of the property described in this application, that I shall occupy or actually occupied same

on January 1 of the year for which application is made, that I am an eligible applicant for the homestead exemption

applied for, qualifying or meeting the definition of the word “applicant” as defined in O.C.G.A. 48-5-40 and that no

transaction has been made in collusion with another for the purpose of obtaining a homestead exemption contrary to

law.

X_

Homestead Claimant Signature

Date

Day Time Telephone #

E-Mail Address

Application received this

20

BY: ________________________________

Steven B. Kendrick, Tax Commissioner

Approved Denied – Tax Commissioner's Office

Approved Denied – Board of Tax Assessors

IF THIS APPLICATION IS DENIED, THE APPLICANT MAY APPEAL WITHIN 45 DAYS. SUCH APPEAL SHALL BE MADE IN THE SAME MANNER THAT OTHER

PROPERTY TAX APPEALS ARE MADE PURSUANT TO CODE SECTION 48-5-311.

Mail signed homestead exemption application to: Richmond County Tax Commissioner’s Office

530 Greene Street - Room 117 Municipal Building – Augusta, Georgia 30901

Any person who makes any false or fraudulent claims for exemption shall be guilty of a misdemeanor.

In addition, the property shall be taxed in an amount DOUBLE the tax otherwise to be paid under

O.C.G.A. 48-5-51.

(November 2011)

1

1 2

2