Distribution Request Form Ira Page 2

Download a blank fillable Distribution Request Form Ira in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Distribution Request Form Ira with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Distribution Request from IRA

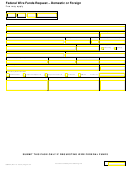

Sub Firm #

BR Code

FA Code

Account Number

(Office Use Only)

ROLLOVER ELIGIBILITY

IRS Rollover Eligibility Limitations - Effective January 1, 2015

The IRS has revised its guidance for completing 60-day IRA-to-IRA rollovers. In the Client Signature & Acknowledgement section below, you will be certifying

that you have read and understand the rollover revised guidance. Under the new guidance, effective January 1, 2015, you are permitted to make only one

60-day IRA-to-IRA rollover per one-year (365 day) period. An IRA rollover is defined as IRA funds withdrawn from an IRA and then paid back into an IRA no later

than 60 days after receipt of the distribution. This one 60-day IRA-to-IRA rollover per year limitation applies on an aggregate basis for all IRAs of any type owned

by any one individual. The one-year period begins on the date you receive the distribution. There continues to be no limit on the number of IRA transfers that can

be completed. An IRA transfer occurs when funds are transferred from an IRA at one institution directly to an IRA at a different institution, and the distribution

check is payable to the new IRA custodian (not the IRA owner), or the funds are transmitted directly to the new IRA custodian. The once-every-365-day rule

does not apply to a rollover from a qualified employer-sponsored plan to an IRA or to a Roth IRA conversion.

TAX WITHHOLDING CERTIFICATIONS AND ELECTIONS

Withholding elections are made by choosing one option in the Federal Taxes and one option in the State Taxes section. If you are eligible to elect out

of Federal or State withholding and decide to do so, you will be liable for taxes due on the taxable portion of your distribution and potential penalties

for underpayment of estimated taxes. You should consult with your tax advisor before making your elections. To withhold taxes from standing

instructions (oral requests for distributions), elect a withholding percentage; a dollar amount is not permitted. After completing this form, to make a

change to a Federal and/or State withholding election, a new form and signature are required.

Federal

You cannot elect out of the 10% mandatory withholding if you have not supplied First Clearing, LLC with your correct SSN or TIN and a

Taxes

“residence address” within the United States. If no election is made we are required to withhold Federal income taxes at a rate of 10% of

W-4P

the gross distribution amount. If you elect to withhold a percentage or a dollar amount, the value must be equal to or greater than 10% of the

gross distribution amount.

OMB No.

1547-0074

Selection Required (choose one)

Do NOT withhold Federal income tax from my IRA distribution.

Withhold Federal income tax of

%

or

$

from my IRA distribution.

Withholding is required in some states if Federal withholding applies, unless you specifically elect out. Residents of CA or VT: The withholding

State

Taxes

rate applies to the Federal withholding amount and not the gross distribution amount. Residents of MI: If you elect out, you are certifying your

distribution is not taxable because you were born before 1946 or you believe that you will not have a balance due on your MI-1040. Residents

of Washington DC: Taxes will be withheld at the rate of 8.95% on total distributions with no option to elect out.

State taxes will be withheld based on the state listed on your account registration.

Selection Required (choose one)

Do NOT withhold State income tax from my IRA distribution.

Withhold State income tax of

%

or

$

from my IRA distribution.

CLIENT SIGNATURE AND ACKNOWLEDGEMENT

I certify that I am the proper party to receive payment(s) from this IRA and that all information provided is true and accurate. I further certify that no tax advice has

been given to me by First Clearing, LLC, my Financial Advisor or the broker-dealer servicing my account. I expressly assume the responsibility for any tax

implications and any adverse consequences which may arise from this withdrawal. I agree that First Clearing, LLC and any of its affiliates may reasonably rely

on my certification without further investigation or inquiry and shall not be liable for any misrepresentation of fact.

Signature of IRA Holder, POA Attorney-in-Fact or Beneficiary

Print Name

Date (mm/dd/yyyy)

X

Verbal instructions allowed only for updates to periodic distributions when canceling, changing frequency, distribution amount, or cycle date.

Office Use Only

Authorized Account Holder:

Personally known to me;

Verbal instructions

or

Confirmed by two pieces of identification

(e.g., SSN, DOB, recent account activity)

1.

2.

from Client

Associate:

585254 (Rev 15 - 03/15) Page 2 of 4

Accounts carried by First Clearing, LLC

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4