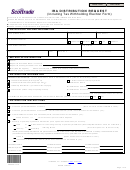

Distribution Request Form Ira Page 3

Download a blank fillable Distribution Request Form Ira in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Distribution Request Form Ira with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

REASONS FOR DISTRIBUTION FROM IRAs AND REQUIRED ATTACHMENTS

Normal (after age 59½). Check this box if you are over age 59½. Generally, once an IRA participant has reached age 59½, assets may be withdrawn from an IRA without

incurring any penalties. It is also considered a “normal” distribution if you are over age 70½ and are taking your Required Minimum Distribution (Traditional, SEP, SIMPLE).

Special rules may apply to Roth IRA distributions. For more information, see section below titled Additional Information on Distributions From a Roth IRA.

Premature (before age 59½) - no known exception. Check this box if you are under age 59½ and there is no known exception. You should also check this box if you are

under age 59½ and are taking a distribution for one of the following reasons: (1) the distribution is for qualified deductible medical expenses; (2) the distribution is to pay for

medical insurance, because you are unemployed and meet the other IRS requirements; (3) you are paying for certain qualified higher education expenses; or (4) the distribution

is for a “first time” home purchase ($10,000 lifetime limit). The penalty tax on premature distributions is generally equal to 10% of the taxable amount of the premature

distribution. The penalty tax is in addition to regular income taxes due. The penalty tax is not paid at the time of the distribution, but paid directly to the IRS when filing your tax

return. If applicable, complete IRS Form 5329 to claim an exception to the 10% penalty. Do not check this box if you are taking a series of substantially equal payments under

IRC 72(t), or are converting a Traditional IRA to a Roth IRA. See applicable section below.

IRA to Qualified Retirement Plan. You can withdraw assets that have been held in an IRA and roll over to an employer's Qualified Retirement Plan. Examples of Qualified

Plans are Pension Plans, 401(k), Money Purchase, Keogh, Profit Sharing, Tax Sheltered Annuity, Thrift Savings Plan, 457 Plan and 403(b). If you select this option, all assets

being withdrawn must be registered and made payable to the Trustee of the Plan. Attach a signed Letter of Acceptance from the receiving Plan Administrator.

Death. If an IRA participant dies before reaching age 59½ or if an Education Savings Account is paid out due to the death of the original Designated Beneficiary (child), the

assets can be distributed to the beneficiary without having to pay the 10% (or 25%) penalty tax, regardless of the beneficiary’s age. Attach (1) copy of Death Certificate; (2) copy

of Enrollment form or Change of Beneficiary form, whichever is most recent; (3) if this distribution form is signed by a representative of the estate, certified Letters of

Administration; (4) if a trust is the beneficiary, a copy of the trust agreement may be requested; and (5) if the designated beneficiary is disclaiming their interest, attach your

Certified Disclaimer and the FCC IRA Beneficiary Disclaimer Certification form. All assets being withdrawn due to death of the accountholder must be registered and made

payable to the beneficiary or beneficiaries. The IRA Beneficiary Surviving Child Certification, completed by the IRA participant's Personal Representative, will be required if (1)

the children are named as primary or contingent Beneficiary and an election was made by the IRA participant to have the beneficiaries share in the IRA per stirpes, or (2) FCC is

required to pay to unnamed children of the deceased IRA participant.

Divorce. If you are required to transfer some or all of the assets in your IRA to your spouse or former spouse due to a divorce or separate maintenance agreement, generally the

assets are directly transferred to the (ex)spouse’s IRA. Attach a copy of the court executed divorce decree or separate maintenance agreement, along with additional paperwork,

as may be required.

Disability. You can withdraw amounts from your IRA without having to pay the 10% (or 25%) penalty tax if you become disabled before you reach age 59½ or you are taking a

distribution due to disability from an Education Savings Account. In order to qualify, you must be disabled within the meaning of IRC 72(m)(7). Generally, the IRS considers you

disabled if you cannot do any substantially gainful activity because of your physical or mental condition. Your physician must determine that the condition is expected to be of

“long-continued or indefinite duration”, or that the condition can be expected to lead to death. The IRS will make the final determination as to whether you are entitled to this

exception.

Early SIMPLE. Check this box if you are withdrawing amounts from your SIMPLE IRA in the first two years, are under age 59½ and none of the exceptions under section 72(t)

are known to apply. The 2-year period begins on the date the first contribution was deposited into your SIMPLE account. Do not check this box if the distribution is due to death

or disability. See the applicable Death or Disability paragraph for more information. The penalty tax on Early SIMPLE distributions is generally 25% of the taxable amount of the

Early SIMPLE distribution. The penalty tax is in addition to any regular income taxes due. The penalty tax is not paid at the time of the distribution, but paid directly to the IRS

when filing your tax return. Early SIMPLE distributions are reported as Code S on IRS form 1099-R.

Substantially Equal Periodic Payments - 72(t). If you are taking a series of substantially equal periodic payments (SEPP) under IRC 72(t) do not complete this form. To

establish 72(t)/SEPP distributions, complete the SEPP/72(t) Distribution Request form (592240).

Roth Conversion. If you are converting a Traditional IRA to a Roth IRA, do not complete this form; complete the Roth Conversion form (585756).

Excess Contribution. To request the removal of an excess contribution or to recharacterize a contribution, do not complete this form; complete the IRA Recharacterization or

Removal of Excess Contribution form (589978).

ADDITIONAL INFORMATION ON DISTRIBUTIONS FROM A ROTH IRA

Roth IRA - Return of Principal (Contribution). When you take a distribution from a Roth IRA, the principal basis (contribution dollars) is distributed first and is generally tax and

penalty free. Special rules may apply if you have deposited a conversion from a Traditional IRA to your Roth IRA.

Roth IRA - Return of Earnings. When you take a distribution of earnings from your Roth IRA, those amounts are taxable unless you meet the reason for a tax-free Qualified

Distribution as described below. The portion of the non-qualified distribution that represents earnings will also be subject to the 10% additional income tax for premature

distributions, unless an exception applies (see above).

Roth IRA - Qualified Distribution. A qualified distribution is one made after the end of the 5-year period beginning with the first taxable year for which you made a contribution

to a Roth IRA AND (1) on or after you attain age 59½; (2) payable to a beneficiary after your death; (3) due to becoming permanently disabled; or (4) for qualified first time

homebuyer expenses ($10,000 lifetime limit). Please note, 2003 is the earliest that the 5-year waiting period could have been satisfied.

ADDITIONAL INFORMATION REGARDING TAX WITHHOLDING

•

The minimum amount of federal taxes that can be withheld is 10% of the gross distribution amount.

•

If you are a U.S. citizen or resident alien and your address of record with us is outside the United States, or its possessions, federal income taxes are required to be withheld

in the amount of 10% from all IRA distributions. You may not elect out of this mandatory withholding.

•

If you are a non-resident alien (not a U.S. citizen or resident alien), federal taxes are required to be withheld in the amount of 30% from all IRA distributions.

•

An election not to have federal income tax withheld is void if a TIN or SSN is not provided or when an obviously incorrect taxpayer identification number is furnished.

•

In certain states, tax withholding is required on IRA distributions unless you specifically elect out of state withholding. States have various withholding requirements. You

should consult your tax advisor or your state department of revenue for additional information.

•

State withholding is not an option for states that do not have a state income tax.

•

State taxes will be withheld based on the state listed on your account registration.

•

Amounts withheld will be remitted on your behalf and will be reflected on the IRS Form 1099R that you will receive from FCC in January of next year.

•

Amounts elected for state withholding are in addition to any fees and Federal income tax withholding.

ON-DEMAND DISTRIBUTIONS

"On-Demand" distributions are withdrawals authorized by you upon verbally contacting your Financial Advisor. To establish On-Demand distributions, select On-Demand in the

"Distribution Instructions: Type" section of this Distribution Request from IRA form, which must be completed and signed by you. Distributions of stock will be valued by using

the closing price from the prior market business day. You may choose to have federal and/or state taxes withheld from your On-Demand distribution. However, to ensure that

withholding regulations are satisfied, you may only select a withholding PERCENTAGE. Your withholding election can be changed or revoked at any time by completing a new

distribution form. Once On-Demand distributions have been established, a new distribution form needs to be completed and signed by you when changes are made to the

"Reason for Distribution", the "Method", or the federal or state withholding election. Only one On-Demand distribution form may be in effect at a time, and a separate form is

needed for each of your IRAs. Only one set of instructions is allowed per IRA.

This information may answer some of your questions, but it is not intended as a comprehensive analysis of this complex topic. First Clearing, LLC periodically provides

information to clients concerning planning. No one should infer that because of this service, First Clearing, LLC assumes any fiduciary duties. In addition, such services should

not be relied upon as your only source of information. Competent tax and legal advice should always be obtained.

585254 (Rev 15 - 03/15) Page 3 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4