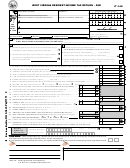

It-140 - West Virginia Personal Income Tax Return - 2015 Page 2

ADVERTISEMENT

PRIMARY LAST NAME

SOCIAL

SHOWN ON FORM

SECURITY

IT-140

NUMBER

10

.00

10. Total Taxes Due (from previous page)..............................................................................

11. West Virginia Income Tax Withheld (SEE INSTRUCTIONS)

CHECK HERE IF WITHHOLDING IS FROM NRSR

11

.00

(NON RESIDENT SALE OF REAL ESTATE)......................................................................................................................................

12

.00

(VWLPDWHG 7D[ 3D\PHQWV DQG 3D\PHQWV ZLWK 6FKHGXOH /

13

.00

13. Senior Citizen Tax Credit for property tax paid from Schedule SCTC-1...............................................................................................

14

.00

+RPHVWHDG ([FHVV 3URSHUW\ 7D[ &UHGLW IRU SURSHUW\ WD[ SDLG IURP 6FKHGXOH +(37&

15

.00

15. Credits from Tax Credit Recap Schedule (see schedule on page 6) ..................................................................................................

16

.00

16. Amount paid with original return (amended return only) .....................................................................................................................

17

.00

3D\PHQWV DQG &UHGLWV

DGG OLQHV WKURXJK

18

.00

18. Overpayment previously refunded or credited (amended return only) ................................................................................................

19

.00

19. Total payments and credits (line 17 minus line 18)..............................................................................................................................

20

.00

3HQDOW\ 'XH IURP )RUP ,7

CHECK IF REQUESTING WAIVER/ANNUALIZED WORKSHEET ATTACHED If you owe penalty, enter here

21

.00

21. Subtract line 20 from line 19 and enter total, (if line 20 is larger, subtract 19 from 20 add to line 10 and enter on line 22)

...................

22

.00

%DODQFH RI ,QFRPH 7D[ 'XH

OLQH PLQXV OLQH

,I OLQH LV JUHDWHU WKDQ OLQH VNLS WR OLQH

23

.00

23. If line 21 is greater than line 10, subtract line 10 from line 21. This is your income tax overpayment..................................................

:HVW 9LUJLQLD 8VH 7D[ 'XH RQ RXWRIVWDWH SXUFKDVHV

VHH 6FKHGXOH 87 RQ SDJH

,I WKLV DPRXQW LV JUHDWHU WKDQ OLQH JR RQ

24

.00

to line 25. If this amount is less than line 23, skip to line 26................................................................................................................

25

.00

25. Subtract line 23 from line 24 and add line 22, this is the total balance of tax due.............................................................................

26

.00

26. Subtract line 24 from line 23, this is your total overpayment..............................................................................................................

27

.00

27. Amount of overpayment to be credited to your 2016 estimated tax.....................................................................................................

28. West Virginia Children’s Trust Fund to help prevent child abuse and neglect.

28

.00

Enter the amount of your contribution

$5

$25

$100

Other

$______________

............................................

29

.00

'HGXFWLRQV IURP \RXU RYHUSD\PHQW

$GG OLQHV DQG

REFUND

30

.00

30. Refund due you (subtract line 29 from line 26).................................................................................................

3$< 7+,6 $02817

31

.00

31. Total amount due the State (line 25 plus line 28) PAY THIS AMOUNT.......................................................

Direct

Deposit

CHECKING

SAVINGS

of Refund

ROUTING NUMBER

ACCOUNT NUMBER

PLEASE REVIEW YOUR ACCOUNT INFORMATION FOR ACCURACY. PROVIDING INCORRECT ACCOUNT INFORMATION MAY

RESULT IN A $15.00 RETURNED PAYMENT CHARGE.

Under penalties of perjury, I declare that I have examined this return, accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct and complete. I authorize the State Tax Department to discuss my return with my preparer.

YES

NO

Your Signature

Date

Spouse’s Signature

Date

Telephone Number

Signature of preparer other than above

Date

Address

Telephone Number

MAIL TO:

REFUND

BALANCE DUE

Preparer: Check here if

WV State Tax Department

WV State Tax Department

client is requesting that

P.O. Box 1071

P.O. Box 3694

Preparer’s EIN

IRUP 127 EH H¿OHG

Charleston, WV 25324-1071

Charleston, WV 25336-3694

Payment Options

5HWXUQV ¿OHG ZLWK D EDODQFH RI WD[ GXH PD\ XVH DQ\ RI WKH IROORZLQJ SD\PHQW RSWLRQV

‡

&KHFN RU 0RQH\ 2UGHU ,I \RX ¿OHG D SDSHU UHWXUQ HQFORVH \RXU FKHFN RU PRQH\ RUGHU ZLWK \RXU UHWXUQ ,I \RX HOHFWURQLFDOO\ ¿OHG PDLO \RXU FKHFN RU PRQH\ RUGHU ZLWK WKH SD\PHQW YRXFKHU ,79

that is provided to you after the submission of your tax return.

‡

(OHFWURQLF )XQGV 7UDQVIHU ,I \RX HOHFWURQLFDOO\ ¿OHG \RXU UHWXUQ \RXU WD[ SD\PHQW PD\ EH DXWRPDWLFDOO\ GHGXFWHG

IURP \RXU FKHFNLQJ DFFRXQW <RX PD\ HOHFW WR DXWKRUL]H WKH ZLWKGUDZDO WR RFFXU DW WKH WLPH WKH UHWXUQ LV ¿OHG RU

*p40201502F*

GHOD\ SD\PHQW DQ\ WLPH EHWZHHQ ¿OLQJ DQG GXH GDWH RI $SULO

‡

Payment by credit card – Payments may be made using your Visa® Card, Discover® Card, American Express®

Card or MasterCard®. Visit tax.wv.gov.

–2–

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2