State Senior Management Service Employees - Retirement Plan Enrollment Form Page 2

ADVERTISEMENT

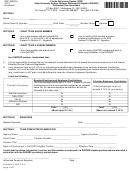

How to enter your investment fund selection:

Write the percentage you wish to allocate to each investment option. Use whole percentages only.

Choose your investment funds from retirement date funds, other investment funds OR from a combination of the two.

The total of all your selections must equal 100%.

If you do not select any investment funds below, you will be automatically defaulted to an appropriate Retirement Date

Fund based on your current age.

RETIREMENT DATE FUNDS: If you are unsure about which investment funds to choose, you may want to consider a

diversified investment portfolio that bests fits your career time horizon until anticipated retirement date. Retirement Date

Funds are designed to offer diversified portfolios for members who would rather use professionally managed asset

allocation funds rather than build their own retirement portfolios. These Funds are designed to provide a single fund whose

asset allocation changes over time during your working career. If you select this option, you are selecting a fund based on

st

factors such as your age as of July 1

of this year and a projected retirement date appropriate for your retirement goals.

The asset allocation of these funds is subject to change. Funds and fees are as of July 1, 2016.

You might consider the

You might consider the

following if you are Special

following if you are

Fund Name

Risk or Special Risk Admin

Regular Class and:

and:

Percentage

Age 26 or younger

FRS 2055 Retirement Fund ($0.70)

%

Age 27 to Age 31

Age 26 or younger

FRS 2050 Retirement Fund ($0.70)

%

Age 32 to Age 36

Age 27 to Age 31

FRS 2045 Retirement Fund ($0.70))

%

Age 37 to Age 41

Age 32 to Age 36

FRS 2040 Retirement Fund ($0.70)

%

Age 42 to Age 46

Age 37 to Age 41

FRS 2035 Retirement Fund ($0.80)

%

Age 47 to Age 51

Age 42 to Age 46

FRS 2030 Retirement Fund ($1.00)

%

Age 52 to Age 56

Age 47 to Age 51

FRS 2025 Retirement Fund ($1.20)

%

Age 57 to Age 61

Age 52 to Age 56

FRS 2020 Retirement Fund ($1.30)

%

Age 62 to Age 66

Age 57 to Age 61

FRS 2015 Retirement Fund ($1.50)

%

Age 67 or Older

Age 62 or Older

FRS Retirement Fund ($1.50)

%

OTHER INVESTMENT FUNDS: If you prefer to create your own customized portfolio choose from the investment funds listed

below. A “B” after a fee means the fund will automatically block trades from occurring under certain circumstances. Funds and

fees are as of July 1, 2016.

Asset Class Description

Fund Name

Percentage

Money Market

FRS Money Market Fund ($0.60)

%

Real Assets

FRS Real Assets Fund ($4.50)

%

Bond

FRS U.S. Bond Enhanced Index Fund ($0.50)

%

FIAM Intermediate Duration Pool Fund ($1.21)

%

FRS Core Plus Fixed Income Fund ($2.40)

%

US Equity

FRS U.S. Large Cap Equity Fund ($3.30)

%

FRS U.S. Stock Market Index Fund ($0.20)

%

FRS U.S. Small/Mid Cap Equity Fund ($6.60)

%

Foreign Equity

FRS Foreign Stock Index Fund ($0.30 B)

%

American Funds EuroPacific Growth Fund ($4.90 B)

%

Global Equity

American Funds New Perspective Fund ($4.90 B)

%

TOTAL MUST EQUAL 100%

%

An Important Note About Fees:

Each investment fund charges an annual fee based on a percentage of the balance invested in that fund. Fees will vary

by fund and are automatically deducted from your account. These are the only fees you will pay as an active member of

the FRS Investment Plan. To make it easier for you to compare fees, the dollar amounts listed (in bold italics) next to the

name of each FRS Investment Plan fund are the first-year annual fee for a $1,000 account balance. Note: The fees listed

on this form may have changed since the form was printed. For the latest fee and fund information, visit .

Fees reduce your retirement benefit. Over 30 years, an annual fee of 0.50% on a fund ($5 per $1,000 account balance)

will reduce your final account balance by approximately 15%. For more information about each FRS Investment Plan

fund, please review the fund profiles and the Investment Fund Summary available at or call the MyFRS

Financial Guidance Line to speak with an unbiased financial planner.

MyFRS Financial Guidance Line 1-866-446-9377 (TRS 711)

Last 4 Digits of Social Security Number: __________________

PAGE 2 OF 4

SMS-1 Rev 07-16

19-11.006 F.A.C.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4