State Senior Management Service Employees - Retirement Plan Enrollment Form Page 3

ADVERTISEMENT

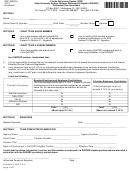

SECTION 3: SMSOAP FUND SELECTIONS (Complete this section only if you selected Option 4 in Section 1.)

SMSOAP RESOURCES: Please designate the company(ies) in which you wish to participate, with the portion of the

contribution you wish to designate to each. You should also indicate any employee after tax contributions you wish to

make to each fund. Be sure to contact the marketing companies for the SMSOAP investment funds to get your questions

answered.

How to enter your investment fund selection: Write the percentage you wish to allocate to each investment provider

for employer/mandatory employee contributions and any after-tax contributions you will make. The total of all your

selections for the employer contributions must equal 6.27%.

Employer Contributions – 6.27%

(The 3% required employee

contributions will be allocated in

Your Voluntary Contributions (Not to

Provider Company

the same ratio.)

exceed 6.27% of your salary)

VOYA

________________ %

__________________ %

TIAA-CREF

________________ %

__________________ %

VALIC

________________ %

__________________ %

AXA

________________ %

__________________ %

TOTAL

6.27%

__________________ %

I have reviewed the investment fund options offered by the above marketing companies and have signed the

necessary contract(s) with the company(ies) for the deposit of your contributions as noted above.

SECTION 4: BENEFICIARY DESIGNATION

If I chose Option 1, 2 or 3, I understand that I can designate a beneficiary at any time. If I do not designate a beneficiary,

my benefits (if any) will be distributed in the event of my death in accordance with s. 121.091(8) or s. 121.4501(20),

Florida Statutes, as applicable. I can designate a beneficiary by completing a Beneficiary Designation Form (BEN-001

Pension Plan or IPBEN-1 Investment Plan). Both forms are available online at or by calling the MyFRS

Financial Guidance Line. If I chose Option 4, in order to designate a beneficiary for the SMSOAP, I understand that I

must contact the providers for those plans.

SECTION 5: AUTHORIZATION (All participants MUST complete this section.)

IMPORTANT INFORMATION: Before signing this enrollment form, be sure to read the following information:

nd

If you elected Options 1, 2, or 3 in Section 1, you understand that you have a one-time future opportunity, called the 2

Election, to switch to the other FRS retirement plan during your FRS career, and that there may be a cost for doing so.

nd

You understand that you cannot file a 2

Election using this form. You understand you can find a description of your

rights and responsibilities under the Pension Plan and the Investment Plan in the respective Summary Plan Descriptions,

Florida Statutes, Administrative Rules, and by calling the MyFRS Financial Guidance Line, Option 2, or visiting

.

If you selected Option 1 in Section 1 (Elected the Pension Plan): You understand that the Pension Plan is a defined benefit

plan, which will provide you with benefit payments at retirement if you meet certain criteria. As of the most recent actuarial

valuation date, the FRS actuarial liability exceeded the actuarial value of its assets yielding an unfunded actuarial liability. This

liability may increase or decrease in the future. The Legislature may increase or decrease the amount that you and your

employer contribute to this plan to keep it actuarially funded.

If you selected Option 2 in Section 1 (Elected the Investment Plan): You understand and acknowledge the following: Any

accrued value you may have in the Pension Plan will be transferred to your Investment Plan account as your opening

balance and is subject to the vesting requirement of the Pension Plan. You can find out the accrued value in your Pension

Plan account by calling the MyFRS Financial Guidance Line, Option 3, to connect to the Division of Retirement. The initial

transfer amount is an estimate and your account will be reconciled within 60 days of that transfer using your actual FRS

membership record pursuant to Florida law and the reconciled amount could be more or less than the estimated amount of

the transfer and that your account will be adjusted accordingly. You direct all future contributions be deposited in your

Investment Plan account.

If you selected Option 2 or 3 in Section 1 (Elected the FRS Investment Plan or FRS Hybrid Option): You acknowledge

and understand that you reviewed the Fund Profiles, the Investment Fund Summary, and the Annual Fee Disclosure

Statement in the “Investment Funds” section at before selecting any investment funds or submitting this form.

You understand you can request a printed copy of these items be mailed to you at no cost by calling the toll-free MyFRS

Financial Guidance Line, Option 4.

MyFRS Financial Guidance Line 1-866-446-9377 (TRS 711)

Last 4 Digits of Social Security Number: __________________

PAGE 3 OF 4

SMS-1 Rev 07-16

19-11.006 F.A.C.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4