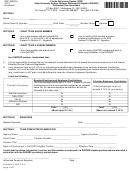

State Senior Management Service Employees - Retirement Plan Enrollment Form Page 4

ADVERTISEMENT

You can change your fund allocations at any time after your account is activated by logging onto or calling the

toll-free MyFRS Financial Guidance Line, Option 4. Your account will be available by the end of the effective month of this

election. If you didn’t choose specific investment funds, you direct your assets to be invested in an age-appropriate

retirement date fund based on your current age. The Investment Plan is not designed to facilitate short-term excessive fund

trading. Foreign and global investment funds are subject to a minimum holding period of 7 calendar days following any non-

exempt transfers into such funds, and you may be subject to trading controls on other funds in the event that you trade

excessively.

You also acknowledge and understand that investment management fees will be deducted from your Investment Plan

account and that these fees may change in the future and that funds may be added or terminated. If any of the funds you

select in the Investment Plan are terminated in the future, you will be able to move your assets into other investment funds

prior to termination. Otherwise, your assets in the terminated fund(s) will automatically be moved into a replacement fund

designated at that time. If you terminate employment and am vested in your account balance, you may be subject to a

mandatory payout of your account if the balance is $1,000 or less, or an account maintenance fee of $6 per quarter if your

account balance is more than $1,000.

You understand that Sections 121.4501(8)(b)2 and 121.4501(15)(b) of Florida law incorporate the federal law concept of

participant control, established by regulations of the U.S. Department of Labor under Section 404(c) of the Employee

Retirement Income Security Act of 1974. If you exercise control over the assets in your Investment Plan account, pursuant to

Section 404(c) regulations and all applicable laws governing the operation of the Investment Plan, no program fiduciary shall

be liable for any loss to your account which results from your exercise of control.

You understand that the Investment Plan is a defined contribution plan in which the Florida Legislature can increase or

decrease the amount that you and your employer contribute to your account.

If you selected Option 4 in Section 1 (Elected the SMSOAP): You understand you elected the SMSOAP and you must

execute a contract with a SMSOAP provider during your first 90 days of employment or you will default into the Pension

Plan. You also understand that your membership in any other state-administered retirement plan will terminate on the

effective date of your enrollment in the SMSOAP. You understand, as a member of the SMSOAP, you are not eligible for

disability retirement benefits under any FRS-administered retirement plan. You understand the State of Florida does not

guarantee nor insure the benefits paid under this program. You understand that your payroll-deducted contributions are

pretax and that it is mandatory to contribute 3% of your salary to the Plan. The 3% mandatory contributions will be sent to

the same provider company(ies) as receives the employer contributions. You have the option to make additional post-tax

contributions of up to 6.27% of your eligible compensation.

SIGN HERE (Your form cannot be processed without your signature.)

______________________________________

________________

_________________________

Signature

Date

Daytime Telephone Number

__________________________________

______________________________________________

Personal E-mail

Employing Agency Name (Optional)

FAX OR MAIL YOUR COMPLETED FORM TO (Retain a copy for your records):

Fax: 1-888-310-5559

Mail:

FRS Plan Choice Administrator

(Do not include a cover sheet.)

P.O. Box 785027

Orlando, FL 32878-5027

(Do not mail this form to your employer or to the Division of Retirement.)

Carefully review your form and make sure you sign and date it before mailing it. Please keep a copy for your records.

CAUTION: Your form will not be processed if you submit a form that does not indicate your plan choice or your Social

Security number, or does not have your signature. You will be notified if your form is incomplete and was not processed.

You must resubmit a completed form in order for your plan choice election to be processed.

Your choice will become final at 4:00 p.m. ET on the day it is received by the FRS Plan Choice Administrator.

FRS PENSION OR INVESTMENT PLAN: Your Enrollment Form must be received on or before 4:00 p.m. on the

th

last business day of the 5

month following your month of hire. If you elected the FRS Pension Plan, FRS

nd

Investment Plan, or FRS Hybrid Option, you have a one-time future opportunity, known as your 2

Election, to

nd

change plans during your FRS career. You can review information about the 2

Election at .

th

SMSOAP: Your enrollment form must be received on or before 4:00 p.m. ET on the 90

day following your date

of hire.

A confirmation statement will be mailed to your address of record once your completed form is received and

processed. Please allow 2 to 3 weeks to receive it. (Your address of record is submitted to the FRS by your employer.

Make sure your employer is notified of any address changes.)

MyFRS Financial Guidance Line 1-866-446-9377 (TRS 711)

Last 4 Digits of Social Security Number: __________________

PAGE 4 OF 4

SMS-1 Rev 07-16

19-11.006 F.A.C.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4