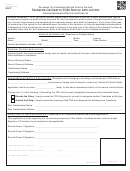

TRANSFER ON DEATH (TOD) AGREEMENT

REGISTRATION OF ACCOUNTS IN BENEFICIARY FORM

The following Agreement shall govern any Transfer on Death (TOD) registration established through your introducing firm (“Broker”),

carried by First Clearing, LLC (“FCC”).

SECTION 1: OPENING YOUR ACCOUNT

A contingent beneficiary will receive a portion of the account assets of a designated primary

To establish a TOD registration of your account, you must complete and submit the TOD application,

beneficiary who dies before the last surviving account owner.

and your Broker and FCC must accept it. Throughout this application and agreement, “We” or “Us”

If you do not designate a contingent beneficiary or if the contingent beneficiary designation does not

refers to your Broker and FCC. We are not required to accept instructions from any other person,

equal 100% for each designated primary beneficiary, and all primary beneficiaries have died, your

including any attorney-in-fact, to establish, revoke or change a TOD registration. FCC may rely on any

assets or a portion of your assets, will go to the estate of the last surviving account owner, unless you

order or instruction it receives from your Broker with respect to your account without further inquiry

have chosen otherwise pursuant to a per stirpes designation. Please consult an estate planning

including any order or instruction received regarding distributions to beneficiaries.

attorney for additional information regarding per stirpes designations.

You must reside in the United States in order to establish a TOD registration. TOD registration is not

SECTION 7: PER STIRPES BENEFICIARY DESIGNATION

available for Louisiana or non-United States residents. If you reside in or move to Louisiana or

You have the option to add a per stirpes designation to your primary or contingent beneficiary

outside of the United States we have the right to terminate any TOD registration.

designation. If you make a per stirpes designation, and the primary or contingent beneficiary, as

Only accounts owned by individuals are eligible for TOD registration. For joint accounts, TOD

applicable, does not survive the last surviving account owner, then any share otherwise payable to

registration is permitted on joint accounts with rights of survivorship (including tenants by the

such beneficiary shall instead be paid to such beneficiary’s descendants by right of representation.

entirety), but not on “tenants in common” joint accounts.

In order to make a per stirpes designation, you must check the per stirpes box associated with the

The following types of assets are not eligible for TOD registration:

primary or contingent beneficiary designation, as applicable. You must also complete the PER

•

Physical securities certificates

STIRPES DESIGNATION section in the application, which designates a personal representative or an

individual serving in a specific capacity to provide your Broker with the proper name(s) of any per

•

Limited partnership interests

stirpes beneficiary.

•

Certificated shares of mutual fund companies

•

Assets held in your name at mutual fund companies

Descendants will include persons within the class living on the date of the designation as well as

•

Commodities

persons born or legally adopted after the date of the designation who are members of the class living

•

Precious metals

on the date of the death of last surviving account owner. If you make a per stirpes designation and

•

Annuities

the particular primary or contingent beneficiary, as applicable, has no descendants, then the share

•

Life insurance policies

otherwise payable to such beneficiary shall be paid to any members of the class of beneficiaries,

either primary or contingent, as applicable, who survived the last surviving account holder in the

We may designate other types of prohibited assets.

proportion that their shares bear to each other. If you make a per stirpes designation, and the

SECTION 2: RELATIONSHIP TO OTHER AGREEMENTS

designation fails due to there being no descendants within an entire class of beneficiaries, either

This TOD Agreement supplements any other agreement(s) relating to your account and will be

primary or contingent as applicable, the assets will be paid to the estate of the last surviving account

governed by the laws of the State of New York. If there are inconsistencies between this TOD

owner. For the purposes of this section 7, beneficiaries shall include a named beneficiary or

Agreement and other agreement(s) governing your account, the terms of this TOD Agreement will

descendants of a deceased named beneficiary eligible to receive assets because of the per stirpes

apply for issues involving your TOD registered account.

designation.

SECTION 3: REVOCATION

SECTION 8: MINOR BENEFICIARIES

To revoke your TOD registration, you (and any other account owners) must complete the TOD

If a beneficiary is a minor, then you must designate a custodian under the Uniform Transfers to

revocation form. Your Broker will not accept a revocation through any other document or through

Minors Act (UTMA). If you have not nominated a custodian for a minor beneficiary, or if the

any other person, including any attorney-in-fact. Revocation will not be effective until your Broker

custodian is unable or unwilling to accept the distribution, we may distribute your assets to an UTMA

accepts the revocation form.

custodian who is later appointed for the minor, or to the minor's conservator or guardian. Custodians

under the Uniform Gifts to Minors Act (UGMA) are not eligible to be beneficiaries or receive

In the case of a joint account, after the death of an account owner, this Agreement shall continue to

distributions.

apply to an account that must be established by the surviving owner or owners unless the surviving

owner or owners change or revoke this agreement by completing our revocation form. Revocation is

SECTION 9: DISTRIBUTIONS

not effective until our acceptance of the revocation form.

After the last surviving account owner dies, no activity in your account will be permitted until the

requirements below are met. Before distributing assets, your Broker must receive the following:

SECTION 4: BENEFICIARIES - GENERAL INFORMATION

a. Legal proof of death of all account owners;

You may establish a TOD naming one or more beneficiaries who do or do not reside in the U.S. Please

b. A copy of our distribution request form, signed by or for each beneficiary or personal

note that your Broker will not accept any TOD beneficiary designation where a beneficiary resides in

representative of the last surviving owner’s estate;

a country that is subject to U.S. Department of Treasury Office of Foreign Asset Control (“OFAC”)

c. A waiver of inheritance or estate taxes (if required under state law).

sanctions. Your Broker is not required to accept instructions from any other person, including any

attorney-in-fact, to name or change beneficiaries.

If a beneficiary is an estate, then your Broker will require (1) letters testamentary for the personal

representative(s), and (2) an affidavit of domicile. If a primary beneficiary dies before the last

You must provide the name, physical address, date of birth, and taxpayer identification number for

surviving account owner, legal proof of death is required.

any beneficiary.

Once your Broker approves these documents, your assets will be distributed in kind to the

If you designate a trust as a beneficiary, you must specify the date the trust was established. For any

beneficiaries according to the percentages in the most recent TOD application on file. Assets will not

trustee you name, your designation includes any co-trustee or successor trustee. If any trust or entity

be sold in your account in order to distribute cash to your beneficiaries. Any residual dividends and

is revoked or terminated before the last surviving account owner's death, your Broker will treat the

interest will be distributed in accordance with the percentages designated in the most recent TOD

trust or entity as if it were an individual who died before the last surviving account owner.

agreement on file with us. In the case of a joint account, after the death of an owner, this agreement

To change a beneficiary, all account owners must complete a new TOD application, and your Broker

shall continue to apply to the account established by the surviving owner or owners unless the

must accept it.

surviving owner or owners change or revoke this agreement.

Your Broker will honor only the most recent beneficiary designation on file.

If any primary beneficiary dies or disclaims his/her interest before the death of the last surviving

A beneficiary has no rights in your account until all account owners have died. From the last surviving

account owner, that primary beneficiary’s share will be distributed to (a) the corresponding

account owner's death until the distribution of assets, all living beneficiaries will be tenants in

contingent beneficiary, (b) the other primary beneficiaries on a pro rata basis, (c) your estate, or (d)

common.

pursuant to your per stirpes designation, depending on the option you have chosen. If you designate

contingent beneficiaries and if any of the contingent beneficiaries die before the last surviving

SECTION 5: PRIMARY BENEFICIARIES

account owner, that share will be distributed to the last surviving account owner’s estate unless you

You must designate one or more primary beneficiaries to whom we will distribute your account

have chosen otherwise pursuant to your per stirpes designation. If the order of death of the last

assets upon the last surviving account owner's death.

surviving account owner or any beneficiary cannot be determined, then it will be assumed that the

You should designate a percentage of assets for each primary beneficiary. If you do not designate

beneficiary died first.

percentages, then all primary beneficiaries will share equally. If you designate percentages and the

Your Broker may reduce or eliminate distributions if your Broker receives written notice from an

total is more than 100%, the primary beneficiaries will share in proportion to their designated

account owner's estate that the assets must be used to pay the estate's expenses. In such case, the

percentages. If you designate percentages and the total is less than 100%, we will distribute the

estate's personal representative may select assets to distribute to the estate.

percentage for which no primary beneficiary is designated to the last surviving account owner's

estate.

When your Broker receives notice of the last surviving account owner's death, we will have no

obligation to:

SECTION 6: CONTINGENT BENEFICIARIES

a. Locate any beneficiary or any account owner’s heirs or representatives of their estates;

You may but are not required to designate one or more contingent beneficiaries for your account.

b. Notify any person of a proposed or completed transfer of your assets; or

Email, fax or mail completed form to:

/ 352-224-1341 / PO Box 358230, Gainesville, FL 32635

TODF.2014.8.11.03

5

1

1 2

2 3

3 4

4 5

5 6

6