c. Verify any information submitted by a person claiming to have an interest in your account.

SECTION 10: FRACTIONAL SHARES

Your beneficiaries must instruct your Broker in writing on how to allocate fractional shares or assets

subject to minimum share or amount designations. If your beneficiaries do not provide such

instructions, your Broker may, but is not required to, sell all fractional or other shares and distribute

the proceeds (after deducting sales commissions and expenses) according to the percentage for each

beneficiary. If your Broker sells any fractional shares or other assets in your account after your death,

the proceeds will be subject to backup tax withholding.

SECTION 11: WELLS FARGO LOAN BALANCE

If your account is pledged to secure a loan balance owed to Wells Fargo Bank, NA when the last

surviving account owner dies, the outstanding loan balance must be paid in full prior to any

distributions. We may, at our sole discretion, sell any and all securities in your account to satisfy any

outstanding balance and your representatives or beneficiaries will not be entitled to choose which

securities

are

sold.

If

the

last

surviving

account

owner

is

deceased,

contact

for instruction on paying off the outstanding loan balance.

SECTION 12: MARGIN OR DEBIT BALANCE

We have the right to reduce any distribution to beneficiaries if there are any outstanding financial

obligations of the account owner, including but not limited to, any margin or debt balance. This shall

include any dividends, interest, earnings or other payments associated with these account assets. We

also have the right to select which assets to sell to pay the margin or debit balance prior to

distribution.

SECTION 13: LIABILITY

We will not have any liability if we pay out interest or dividends after the last surviving account

owner's death and the beneficiaries have not provided your Broker with all of the documents listed

in Section 9 above in a timely manner.

Should the distribution of assets be delayed by the beneficiaries' failure to provide the documents

listed in Section 9 above, or by a dispute or claim to your account, we will not be liable for any

resulting decline in the value of your account.

Once assets from your account are distributed, we will be released fully from any liability.

We will not be liable for failing to notify you of changes in TOD law that may affect your account.

SECTION 14: DISPUTES

If we cannot determine the persons entitled to receive a distribution or their proper share, or if a

dispute by a beneficiary or a beneficiary’s descendants or spouse arises as to the proper distribution,

or if claims to the distribution are made by creditors of the estate, surviving spouse, personal

representative, heirs or others, we reserve the right to require the parties to determine their

respective rights before making any distribution by court order, arbitration or any other manner

acceptable to us prior to making any distribution. We have no duty to withhold the distribution of

assets based on knowledge of any adverse claims unless proper written notice is given which allows

us reasonable opportunity to act, and shall accept no responsibility for any transfers made pursuant

to the Agreement before such notice is given.

SECTION 15: MISCELLANEOUS

You, your estate or your successors-in-interest, including all beneficiaries and heirs, shall fully

indemnify and hold FCC and your Broker, their agents, affiliates, successors and assigns, parent

companies, subsidiaries, officers, directors, shareholders, members, employees and attorneys

harmless from and against all claims, actions, costs, liabilities and damages including attorneys’ fees

arising out of or relating, but not limited to:

•

Any conflicting designation of assets in your account by will, revocable living trust or

any other instrument.

•

Any written change of beneficiaries that you have made that has not been accepted by

Us.

•

FCC or your Broker making distributions upon notice of the death of the last surviving

account holder.

•

Any other action taken in opening and maintaining your account under this agreement

or registering the securities in your account.

We make no representation as to the effectiveness of your beneficiary designations or the tax

consequences of holding this account or distributing assets from it. You should seek legal or other

appropriate counsel regarding all legal and tax issues related to this TOD agreement and registration.

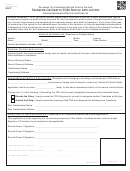

Email, fax or mail completed form to:

/ 352-224-1341 / PO Box 358230, Gainesville, FL 32635

TODF.2014.8.11.03

6

1

1 2

2 3

3 4

4 5

5 6

6