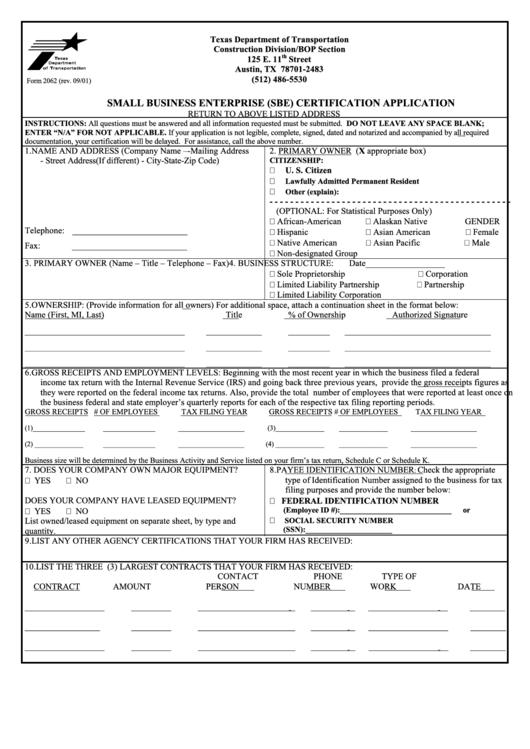

Small Business Enterprise (Sbe) Certification Application

ADVERTISEMENT

Texas Department of Transportation

Construction Division/BOP Section

th

125 E. 11

Street

Austin, TX 78701-2483

(512) 486-5530

Form 2062 (rev. 09/01)

SMALL BUSINESS ENTERPRISE (SBE) CERTIFICATION APPLICATION

RETURN TO ABOVE LISTED ADDRESS

INSTRUCTIONS: All questions must be answered and all information requested must be submitted. DO NOT LEAVE ANY SPACE BLANK;

ENTER “N/A” FOR NOT APPLICABLE. If your application is not legible, complete, signed, dated and notarized and accompanied by all required

documentation, your certification will be delayed. For assistance, call the above number.

1.

NAME AND ADDRESS (Company Name –-Mailing Address

2. PRIMARY OWNER (X appropriate box)

- Street Address(If different) - City-State-Zip Code)

CITIZENSHIP:

U. S. Citizen

Lawfully Admitted Permanent Resident

Other (explain):

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

(OPTIONAL: For Statistical Purposes Only)

African-American

Alaskan Native

GENDER

Telephone: __________________________

Hispanic

Asian American

Female

Native American

Asian Pacific

Male

Fax:

__________________________

Non-designated Group

3. PRIMARY OWNER (Name – Title – Telephone – Fax)

4. BUSINESS STRUCTURE:

Date__________________

Sole Proprietorship

Corporation

Limited Liability Partnership

Partnership

Limited Liability Corporation

5.

OWNERSHIP: (Provide information for all owners) For additional space, attach a continuation sheet in the format below:

Name (First, MI, Last)

Title

% of Ownership

Authorized Signature

______________________________________________

________________

____________

__________________________________________

______________________________________________

________________

____________

__________________________________________

______________________________________________

________________

____________

__________________________________________

6.

GROSS RECEIPTS AND EMPLOYMENT LEVELS: Beginning with the most recent year in which the business filed a federal

income tax return with the Internal Revenue Service (IRS) and going back three previous years, provide the gross receipts figures as

they were reported on the federal income tax returns. Also, provide the total number of employees that were reported at least once on

the business federal and state employer’s quarterly reports for each of the respective tax filing reporting periods.

GROSS RECEIPTS # OF EMPLOYEES

TAX FILING YEAR

GROSS RECEIPTS # OF EMPLOYEES

TAX FILING YEAR

(1)_______________

_______________

___________________

(3)______________

______________

___________________

(2) ______________

_______________

___________________

(4) ______________

______________

___________________

Business size will be determined by the Business Activity and Service listed on your firm’s tax return, Schedule C or Schedule K.

7. DOES YOUR COMPANY OWN MAJOR EQUIPMENT?

8.

PAYEE IDENTIFICATION NUMBER

Check the appropriate

:

YES

NO

type of Identification Number assigned to the business for tax

filing purposes and provide the number below:

DOES YOUR COMPANY HAVE LEASED EQUIPMENT?

FEDERAL IDENTIFICATION NUMBER

YES

NO

(Employee ID #):_____________________________

or

SOCIAL SECURITY NUMBER

List owned/leased equipment on separate sheet, by type and

(SSN):______________________

quantity.

9.

LIST ANY OTHER AGENCY CERTIFICATIONS THAT YOUR FIRM HAS RECEIVED:

10. LIST THE THREE (3) LARGEST CONTRACTS THAT YOUR FIRM HAS RECEIVED:

CONTACT

PHONE

TYPE OF

CONTRACT

AMOUNT

PERSON

NUMBER

WORK

DATE

__________________

_________

______________________

__________

__________________

________

_________________

_________

______________________

__________

__________________

________

__________________

_________

______________________

__________

__________________

________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4