Instructions For Form 8889 - 2016

ADVERTISEMENT

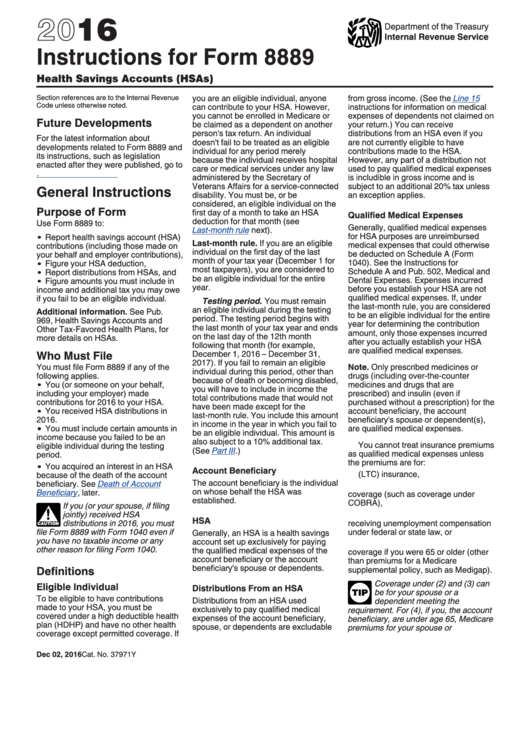

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 8889

Health Savings Accounts (HSAs)

Section references are to the Internal Revenue

you are an eligible individual, anyone

from gross income. (See the

Line 15

Code unless otherwise noted.

can contribute to your HSA. However,

instructions for information on medical

you cannot be enrolled in Medicare or

expenses of dependents not claimed on

Future Developments

be claimed as a dependent on another

your return.) You can receive

person's tax return. An individual

distributions from an HSA even if you

For the latest information about

doesn't fail to be treated as an eligible

are not currently eligible to have

developments related to Form 8889 and

individual for any period merely

contributions made to the HSA.

its instructions, such as legislation

because the individual receives hospital

However, any part of a distribution not

enacted after they were published, go to

care or medical services under any law

used to pay qualified medical expenses

administered by the Secretary of

is includible in gross income and is

Veterans Affairs for a service-connected

subject to an additional 20% tax unless

General Instructions

disability. You must be, or be

an exception applies.

considered, an eligible individual on the

Purpose of Form

first day of a month to take an HSA

Qualified Medical Expenses

deduction for that month (see

Use Form 8889 to:

Generally, qualified medical expenses

Last-month rule

next).

for HSA purposes are unreimbursed

Report health savings account (HSA)

Last-month rule. If you are an eligible

medical expenses that could otherwise

contributions (including those made on

individual on the first day of the last

be deducted on Schedule A (Form

your behalf and employer contributions),

month of your tax year (December 1 for

1040). See the Instructions for

Figure your HSA deduction,

most taxpayers), you are considered to

Schedule A and Pub. 502, Medical and

Report distributions from HSAs, and

be an eligible individual for the entire

Dental Expenses. Expenses incurred

Figure amounts you must include in

year.

before you establish your HSA are not

income and additional tax you may owe

qualified medical expenses. If, under

if you fail to be an eligible individual.

Testing period. You must remain

the last-month rule, you are considered

an eligible individual during the testing

Additional information. See Pub.

to be an eligible individual for the entire

period. The testing period begins with

969, Health Savings Accounts and

year for determining the contribution

the last month of your tax year and ends

Other Tax-Favored Health Plans, for

amount, only those expenses incurred

on the last day of the 12th month

more details on HSAs.

after you actually establish your HSA

following that month (for example,

are qualified medical expenses.

Who Must File

December 1, 2016 – December 31,

2017). If you fail to remain an eligible

You must file Form 8889 if any of the

Note. Only prescribed medicines or

individual during this period, other than

following applies.

drugs (including over-the-counter

because of death or becoming disabled,

You (or someone on your behalf,

medicines and drugs that are

you will have to include in income the

including your employer) made

prescribed) and insulin (even if

total contributions made that would not

contributions for 2016 to your HSA.

purchased without a prescription) for the

have been made except for the

You received HSA distributions in

account beneficiary, the account

last-month rule. You include this amount

beneficiary's spouse or dependent(s),

2016.

in income in the year in which you fail to

You must include certain amounts in

are qualified medical expenses.

be an eligible individual. This amount is

income because you failed to be an

also subject to a 10% additional tax.

You cannot treat insurance premiums

eligible individual during the testing

(See

Part

III.)

as qualified medical expenses unless

period.

the premiums are for:

You acquired an interest in an HSA

Account Beneficiary

1. Long-term care (LTC) insurance,

because of the death of the account

The account beneficiary is the individual

beneficiary. See

Death of Account

2. Health care continuation

on whose behalf the HSA was

Beneficiary, later.

coverage (such as coverage under

established.

COBRA),

If you (or your spouse, if filing

3. Health care coverage while

jointly) received HSA

!

HSA

distributions in 2016, you must

receiving unemployment compensation

CAUTION

file Form 8889 with Form 1040 even if

under federal or state law, or

Generally, an HSA is a health savings

you have no taxable income or any

account set up exclusively for paying

4. Medicare and other health care

other reason for filing Form 1040.

the qualified medical expenses of the

coverage if you were 65 or older (other

account beneficiary or the account

than premiums for a Medicare

beneficiary's spouse or dependents.

Definitions

supplemental policy, such as Medigap).

Coverage under (2) and (3) can

Eligible Individual

Distributions From an HSA

be for your spouse or a

TIP

To be eligible to have contributions

Distributions from an HSA used

dependent meeting the

made to your HSA, you must be

exclusively to pay qualified medical

requirement. For (4), if you, the account

covered under a high deductible health

expenses of the account beneficiary,

beneficiary, are under age 65, Medicare

plan (HDHP) and have no other health

spouse, or dependents are excludable

premiums for your spouse or

coverage except permitted coverage. If

Dec 02, 2016

Cat. No. 37971Y

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6