Tax-Exempt Status Request Form

Download a blank fillable Tax-Exempt Status Request Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Tax-Exempt Status Request Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

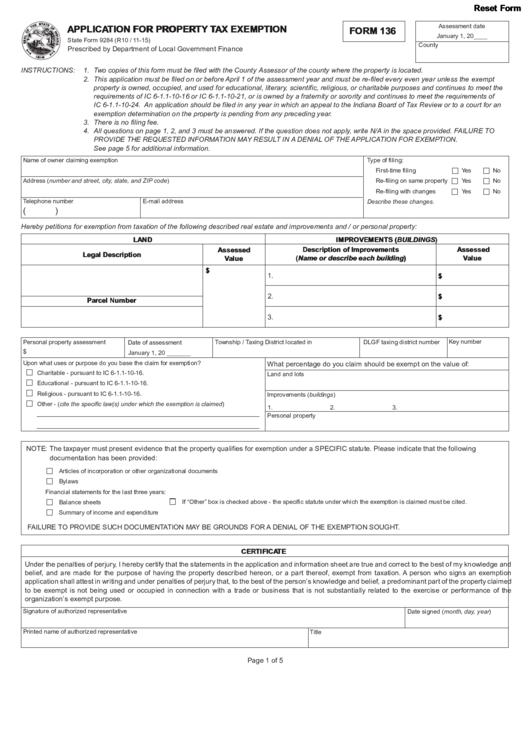

Reset Form

Assessment date

APPLICATION FOR PROPERTY TAX EXEMPTION

FORM 136

January 1, 20____

State Form 9284 (R10 / 11-15)

County

Prescribed by Department of Local Government Finance

INSTRUCTIONS:

1. Two copies of this form must be filed with the County Assessor of the county where the property is located.

2. This application must be filed on or before April 1 of the assessment year and must be re-filed every even year unless the exempt

property is owned, occupied, and used for educational, literary, scientific, religious, or charitable purposes and continues to meet the

requirements of IC 6-1.1-10-16 or IC 6-1.1-10-21, or is owned by a fraternity or sorority and continues to meet the requirements of

IC 6-1.1-10-24. An application should be filed in any year in which an appeal to the Indiana Board of Tax Review or to a court for an

exemption determination on the property is pending from any preceding year.

3. There is no filing fee.

4. All questions on page 1, 2, and 3 must be answered. If the question does not apply, write N/A in the space provided. FAILURE TO

PROVIDE THE REQUESTED INFORMATION MAY RESULT IN A DENIAL OF THE APPLICATION FOR EXEMPTION.

See page 5 for additional information.

Name of owner claiming exemption

Type of filing:

First-time filing

Yes

No

Address (number and street, city, state, and ZIP code)

Re-filing on same property

Yes

No

Re-filing with changes

Yes

No

Telephone number

E-mail address

Describe these changes.

(

)

Hereby petitions for exemption from taxation of the following described real estate and improvements and / or personal property:

LAND

IMPROVEMENTS (BUILDINGS)

Description of Improvements

Assessed

Assessed

Legal Description

Value

(Name or describe each building)

Value

$

1.

$

2.

$

Parcel Number

3.

$

Key number

Personal property assessment

Township / Taxing District located in

DLGF taxing district number

Date of assessment

$

January 1, 20 _______

Upon what uses or purpose do you base the claim for exemption?

What percentage do you claim should be exempt on the value of:

Charitable - pursuant to IC 6-1.1-10-16.

Land and lots

Educational - pursuant to IC 6-1.1-10-16.

Religious - pursuant to IC 6-1.1-10-16.

Improvements (buildings)

Other - (cite the specific law(s) under which the exemption is claimed)

1.

2.

3.

Personal property

NOTE: The taxpayer must present evidence that the property qualifies for exemption under a SPECIFIC statute. Please indicate that the following

documentation has been provided:

Articles of incorporation or other organizational documents

Bylaws

Financial statements for the last three years:

Balance sheets

If “Other” box is checked above - the specific statute under which the exemption is claimed must be cited.

Summary of income and expenditure

FAILURE TO PROVIDE SUCH DOCUMENTATION MAY BE GROUNDS FOR A DENIAL OF THE EXEMPTION SOUGHT.

CERTIFICATE

Under the penalties of perjury, I hereby certify that the statements in the application and information sheet are true and correct to the best of my knowledge and

belief, and are made for the purpose of having the property described hereon, or a part thereof, exempt from taxation. A person who signs an exemption

application shall attest in writing and under penalties of perjury that, to the best of the person’s knowledge and belief, a predominant part of the property claimed

to be exempt is not being used or occupied in connection with a trade or business that is not substantially related to the exercise or performance of the

organization’s exempt purpose.

Signature of authorized representative

Date signed (month, day, year)

Printed name of authorized representative

Title

Page 1 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5