Tax-Exempt Status Request Form Page 3

Download a blank fillable Tax-Exempt Status Request Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Tax-Exempt Status Request Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

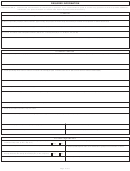

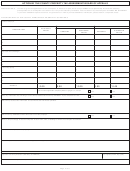

REQUIRED INFORMATION (continued)

III. OTHER INFORMATION (continued)

3. Do the individuals whose activities are related to the exempt purpose ever use

3a. State who makes such use of rooms or areas.

rooms or areas for activities not directly related to the basis for the claimed

exemption? (If “No”, skip to 4.)

3b. State specifically what rooms or areas are so used.

3c. State specifically how often such rooms or areas are to be used.

4a. State the uses for which such fees are charged.

4. Are fees ever charged to those who make use of rooms or

areas? (If “No”, skip to 5.)

Yes

No

4b. State how often such fees are charged.

4c. State who is charged such fee.

4d. State what fee is charged.

4e. For what purpose is the revenue derived from such fee used?

5. How many individuals participate in the

exempt activities?

6a. State the activity.

6. Are any rooms or areas ever used by any income generating

activity? (If “No”, skip to 7.)

Yes

No

6b. State specifically where it occurs.

6c. State specifically how often it occurs.

6d. State who conducts such activity.

7. Are food or items of any sort ever sold?

7a. State what is sold.

(If “No”, skip to 8.)

Yes

No

7b. State specifically where it is sold.

7c. State specifically how often such sales occur.

7d. State specifically who makes such sales.

8a. State the activity.

8. Are dances, dinners or other social functions ever held on the property for which the

exemption is claimed? (If “No”, skip to 9.)

Yes

No

8b. State specifically where it occurs.

8c. State specifically how often it occurs.

8d. State who conducts such activity.

9a. If so, specifically describe such goods, crops or food.

9. Are goods, crops, or food of any sort ever made, grown, or

produced on the property?

Yes

No

9b. State specifically the number or amount of goods, crops or food made, grown or produced.

9c. State specifically where such goods, crops or food is made, grown or produced.

9e. State the dollar value of each good, crop or food made, grown or produced.

9d. State specifically who makes, grows, or produces such goods, crops or food.

Use this area if additional space is needed for answers or if you wish to provide additional information.

Page 3 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5