Tax-Exempt Status Request Form Page 2

Download a blank fillable Tax-Exempt Status Request Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Tax-Exempt Status Request Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

REQUIRED INFORMATION

INSTRUCTIONS:

Please state all information for the tax year in question. If you need additional space to answer any questions or wish to provide additional

information, use space at bottom of reverse side. Attach separate sheet if necessary.

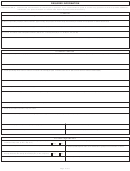

I. GENERAL

1. Who owns the property? (Name, address, type of entity, and purpose for which entity was formed per articles of incorporation or similar documents)

2. Who occupies the property? (Name, address, type of entity, and purpose for which entity was formed per articles of incorporation or similar documents)

3. Who uses the property? (Name, address, type of entity, and purpose for which entity was formed per articles of incorporation or similar documents)

4. For how much land is the exemption claimed? (See IC 6-1.1-10-16(c) and (d), 6-1.1-10-20, 21, 22, and 26)

5. Describe all structures and state specifically the normal use of each room or area in each structure. (You may attach a diagram of the property and structures.)

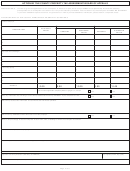

II. EXEMPT PURPOSE

1. State specifically the exempt purpose and activities for which the property is used. (If any publications about the exempt activity are available, please provide a copy.)

2. State how often such activities occur.

3. State specifically what rooms or areas are used for the exempt purpose and what such use is. (Be sure all rooms or areas are discussed.)

4. Who carries out the exempt activities for which the property is used?

4a. State the qualifications of such individual(s).

4b. State if such individual(s) are certified or licensed by an entity, who has issued such certificate or license, and the qualifications required to obtain such certificate or license.

4c. How many individuals or groups participate in the exempt activities?

5. State what written materials, if any, are used.

6. What standards, if any, must individuals or groups benefiting from the exempt activity meet prior to participation in such activities?

7. State if the taxpayer is supervised by any entity, group or individual.

7a. State the name of such entity.

7b. State the address of the entity.

7c. State the nature and purpose of such entity.

III. OTHER INFORMATION

1. Are rooms or areas ever used by individuals or groups for purposes not related to the

1a. Name such individuals or groups.

claimed exempt use? (If “No”, skip to 2.)

Yes

No

1b. State specifically what rooms or areas are used by such individuals or groups.

1c. State specifically how often such individuals or groups use such rooms or areas.

2. Do those benefiting from the exempt activity ever use areas or rooms for activities not

2a. State who makes such use of rooms or areas.

directly related to the activity of the taxpayer? (If “No”, skip to 3.)

Yes

No

2c. State specifically how often such rooms or areas are so used.

2b. State specifically what rooms or areas are so used.

Page 2 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5