OREGON DEPARTMENT OF TRANSPORTATION

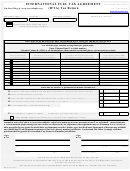

INTERNATIONAL FUEL TAX AGREEMENT (IFTA)

QUARTERLY RETURN FILING INSTRUCTIONS

WHO MUST FILE. Every Oregon-based motor carrier issued a

MINIMUM REQUIRED INFORMATION. The following information

license under the International Fuel Tax Agreement is required to

is required for the return to be accepted:

file an International Fuel Tax Agreement (IFTA) Tax Return, Form

Quarter and year of return

No. 735-9740.

IFTA license number

Oregon Taxpayer ID number

If your IFTA License is revoked, you are still required to file returns

Name and address of taxpayer

for all periods your account remains open. Filing a return does not

Return with no operations or Oregon operations only:

authorize operation in other jurisdictions. Operation in member

Check appropriate box

jurisdictions without valid credentials is illegal and cause for

Return with operations:

citation, fines, and penalties.

Fuel/miles summary columns 1 through 6

Columns A through G completed for a minimum of

one jurisdiction

WHEN AND WHERE TO FILE. This return, properly signed and

Signature and date

accompanied by a check or money order payable to Oregon

Department of Transportation (ODOT/IFTA), will be considered

timely filed if postmarked on or before the last day of the month

FUEL/MILES SUMMARY

following the quarter covered by the return. A return is required for

each quarter even when no fuel tax is due. Mail to Motor Carrier

OTHER:

Indicate fuel type used.

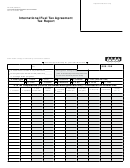

If all lines are full, place

Transportation Division (MCTD), 550 Capitol St. NE, Salem, OR

additional information on a separate sheet of paper and include in

97301-2530.

TOTALS.

FILE ONLINE! You can now file and pay your IFTA tax return

CONVERT metric fuel and distance measurements to gallons and

online through our Web site –

miles using the following factors:

1 liter = 0.2642 gallons; 1

kilometer = 0.62137 miles.

Check the NO OPERATIONS box if none of your qualified

vehicles had operations in the quarter covered by this return.

ROUND all miles and gallons in columns 1 through 5 to the

Check the OREGON OPERATIONS ONLY box if you have

nearest whole number. For example, show 525.5 as 526 and

operated only in the state of Oregon. If you check either of these

show 525.4 as 525.

boxes, information in the Fuel/Miles Summary is not required.

Check the CHANGE OF ADDRESS box if you have changed your

COLUMN 1 OREGON MILES: Enter the total number of miles

address. Mark through the incorrect address and print the correct

traveled in Oregon, including Oregon off-road miles, for each fuel

address. Sign and return to MCTD.

type used.

PREHEADED RETURNS. This return is to be used only by the

COLUMN 2 IFTA JURISDICTION MILES: Enter the total number

motor carrier whose name is printed on it. If you have not received

of miles traveled in all IFTA jurisdictions, including permit miles

a return for a reporting period, request a duplicate from the IFTA

and off-road miles for IFTA jurisdictions (do not include any miles

staff. If the business name, location, or mailing address is not

traveled in Oregon). The TOTAL of this column must be the same

correct, mark through the incorrect information and print the correct

as the GRAND TOTAL of Column C.

information.

COLUMN 3 NON-IFTA JURISDICTION MILES: Enter the total

QUALIFIED MOTOR VEHICLES.

All vehicles in the licensee's

number of miles traveled in all non-IFTA jurisdictions, including

fleet bearing an Oregon IFTA decal must be included on this report,

off-road miles for non-IFTA jurisdictions (do not include any miles

including vehicles bearing Oregon IFTA decals that did not leave

traveled in Oregon):

ALASKA; HAWAII; WASHINGTON, D.C.;

Oregon during the reporting period. Qualifying vehicle means a

NORTHWEST TERRITORY; YUKON TERRITORY; or any other

motor vehicle (1) having two axles and a gross vehicle weight or

jurisdiction not listed on the return form.

registered gross vehicle weight exceeding 26,000 pounds or 11,797

kilograms; or (2) having three or more axles regardless of weight;

COLUMN 4 TOTAL MILES: Total of all miles traveled for each

or (3) used in combination when the weight of such combination

fuel type (Columns 1, 2, and 3 must equal Column 4).

exceeds 26,000 pounds or 11,797 kilograms gross vehicle weight.

COLUMN 5 TOTAL GALLONS: For each fuel type, enter the

AMENDED RETURNS.

If it becomes necessary to correct a

total of all gallons used in all jurisdictions in which you traveled.

previously filed return, please make a copy of the original return

Report all fuel placed in the supply tank of a qualified motor

filed, check the 'AMENDED' box at the top of the form, and make

vehicle.

the necessary changes next to the incorrect figures.

COLUMN 6 AVERAGE FLEET MPG: Calculate miles per gallon

An explanation of the changes must accompany the amended

(MPG) by dividing the number in Column 4 by the number in

return. An amended return may be subject to a late penalty and

Column 5. Carry this calculation to three decimal places, then

interest if amended after the due date.

round to two decimal places. For example, show 5.255 as 5.26,

and show 5.254 as 5.25. Enter the result in Column 6 for each

VERIFICATION AND AUDIT. The records you used to prepare this

fuel type used.

return must be retained and be available for at least four years from

the due date of the return or the date filed, whichever is later.

Form 735-9740c (3-10)

1

1 2

2 3

3 4

4