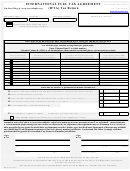

COLUMN B FUEL TYPE: Using the codes below, enter fuel type

COLUMN I TAX DUE OR (CREDIT):

Multiply the amount in

you are reporting on this line. If you use more than one fuel type in

Column G by the amount in Column H. Enter this amount in

a jurisdiction, place additional information on a separate sheet of

dollars and cents, with credit amounts in brackets.

paper.

COLUMN J INTEREST DUE: If this return is filed late, interest is

B – Biodiesel

SG - Surcharge Gasoline

due to each jurisdiction where there is tax due. (A return is late if

D - Diesel

SP - Surcharge Propane

not postmarked on or before the last day of the month following

G - Gasoline

SGH - Surcharge Gasohol

the quarter covered by the return and accompanied by payment of

P - Propane

SLN - Surcharge Liquid Natural

any tax due.) Multiply the Column I amount by 1% for each month

GH - Gasohol

Gas

or partial month the report is late. Do not calculate interest on

LNG - Liquid Natural Gas

SCN - Surcharge Compressed

credit amounts in Column I.

CNG - Compressed Nat Gas

Nat Gas

E - Ethanol

SE - Surcharge Ethanol

COLUMN K TOTAL DUE OR (CREDIT): Total the amounts in

M - Methanol

SM - Surcharge Methanol

E85 - E-85

SE8 – Surcharge E-85

Columns I and J. Enter credit amounts in brackets.

M85 - M-85

SM8 - Surcharge M-85

A55 - A55

SA5 - Surcharge A55

SURCHARGE: Currently, Indiana, Kentucky, and Virginia levy a

SD - Surcharge Diesel

surcharge. If you have traveled in any of these states, use the

second line titled SURCHARGE to calculate your surcharge:

COLUMN C TOTAL MILES IN JURISDICTION: Enter the total

multiply the taxable gallons (Column E) by the surcharge tax rate

miles traveled in each jurisdiction for each fuel type listed. Include

found on the enclosed tax rate sheet.

off-road miles and permit miles.

The GRAND TOTAL of this

column must be the same as in Column 2.

7. TOTAL FUEL TAX AND INTEREST DUE OR (CREDIT): Total

amounts in Column K.

COLUMN D TAXABLE MILES IN JURISDICTION:

Enter the

taxable miles traveled in each IFTA jurisdiction. Contact the

8. PREVIOUS BALANCE DUE: Balance due resulting from a

jurisdiction directly to learn if any of your operations are not taxable.

partial payment, mathematical or clerical error, penalty, or interest

Do not include off-road nontaxable miles or fuel tax permit miles in

relating to prior returns. Add this amount to other amounts due

this column.

and include in your payment.

COLUMN E TAXABLE GALLONS: Divide the amount in Column

9. PREVIOUS CREDIT: This amount represents a credit on your

D by the average miles per gallon from Column 6 for each fuel type

account. Do not pay this amount. Before subtracting this credit

and round to the nearest whole gallon. For example, 525.5 should

from what you owe, verify the credit is valid and has not already

be shown as 526 and 525.4 should be shown as 525.

been refunded or used. All adjustments are subject to audit.

COLUMN F TAX PAID GALLONS: Enter the number of gallons

10. PENALTY: If this return is filed late, enter 10% of the total

purchased in that jurisdiction during this reporting period on which

amount of Column I, or $50, whichever is greater.

fuel taxes have been paid, rounding to the nearest whole gallon.

Purchases must be supported by invoices from the vendor and

11. REINSTATEMENT FEE: If your account was revoked and

retained in your records.

you need to reinstate, include a $25 reinstatement fee.

Your

account will be reinstated only if all deficiencies have been

COLUMN G NET TAXABLE GALLONS: Subtract the amount in

satisfied.

Column F from the amount in Column E. If F is greater than E,

enter the credit figure in brackets (for example, [732]).

12. TOTAL BALANCE DUE OR (CREDIT): If the amount on this

line is a balance due, attach payment. Penalty and interest will

COLUMN H TAX RATE: Enter the tax rate from the tax rate tables

be assessed on tax returns where incorrect calculations

provided. Tax rate tables change each quarter. Use the rate table

result in underpayment. If line 12 is a credit, you may request

for the quarter of the return you are filing.

a refund by checking the box at the top of the return form. All

refunds are subject to verification of the credit to be

refunded. Refunds may take up to 90 days to process.

PLEASE RETAIN A COPY OF YOUR TAX RETURN FOR YOUR RECORDS

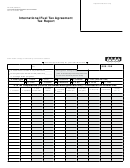

2010 OREGON IFTA CALENDAR

1st Quarter 2010

3rd Quarter 2010

Returns Due By

04-30-2010

Returns Due By

11-01-2010

2nd Quarter 2010

4th Quarter 2010

Returns Due By

08-02-2010

Returns Due By

01-31-2011

Form 735-9740c (3-10)

1

1 2

2 3

3 4

4