Tax Information Authorization Page 2

ADVERTISEMENT

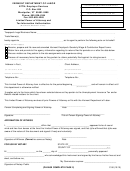

Tax Information Authorization

TAXPAYER FEDERAL IDENTIFICATION NUMBER

TAXPAYER LEGAL NAME

DBA NAME

________________________________________________________________________________________________

Principal Location of Business

941 – Beginning Period

______________ QTR _____________ YR

940 – Beginning Period _____________ YR

Employment Tax Deposits ______________ MO _____________ YR

945 – Beginning Period _________ YR

N/A

943 – Beginning Period

_________ YR

W-2 – Beginning Period _____________ YR

N/A

Ceridian Tax Service, Inc. (CTS) is hereby appointed Reporting Agent with the authority to sign and file employment tax returns, sign and

file employment tax protests, make employment tax deposits electronically, and make magnetic tape or paper filings, for the above stated

taxpayer to Federal, State, and Local Jurisdictions.

Ceridian Tax Service, Inc. (CTS) is authorized as a designee of the Taxpayer to wit: Employment Tax – the filing of reports, payment of

contributions, quarterly statements, annual tax rate notices.

Also designee of the Taxpayer to receive notices, correspondence,

transcripts, deposit frequencies, liability dates and other information pertinent to employment tax returns filed, deposits made by Ceridian

Tax Service, Inc. (CTS) and SUI rates.

This authorization shall begin with the tax period indicated above and remain in effect until notified by the taxpayer, or the designee, of

termination or revocation of this authorization. This authorization applies to the federal employment tax returns noted above and includes

all appropriate State and Local forms. The Tax Information Authorization revokes earlier tax filing Tax Information Authorizations on file

with the taxing authorities with respect to the same tax matters and period covered, but has no effect on any other Authorization.

--------------------------------------------------------------------------------------------------------

SIGNATURE OF TAXPAYER OR AUTHORIZED REPRESENTATIVE

I understand that this authorization does not absolve me as the taxpayer of the responsibility to ensure that all returns are filed and all

taxes are paid on time. I authorize the taxing authorities to disclose otherwise confidential tax information to Ceridian Tax Service, Inc.

(CTS) as necessary to discuss and provide filing or account information relating to employment tax returns filed or to be filed by Ceridian

Tax Service, Inc. (CTS) and/or employment tax deposits made or to be made by Ceridian Tax Service, Inc. (CTS). I certify that I have the

authority to authorize the disclosure of otherwise confidential tax data on behalf of the taxpayer.

_______________________________________________________________________

/

Name/Title (Required) Please Print

S

a

_______________________________________________________________________

______________________________________________

Signature (Required)

Date

CERIDIAN TAX SERVICE, INC. (CTS) – REPORTING AGENT

17390 Brookhurst Street, Suite #100

Fountain Valley, California 92708-3737

_______________________________________________________________________

______________________________________________

Signature – Reporting Agent

Date

41-1902914

______________________________________________

Telephone Number

Identifying Number

Date

QIA-Source Code

Substitute Form 8655

TF-2012 Rev. 4/99

(In accordance with Internal Revenue Service Revenue Procedures)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2