Form Dr-308 - Request And Certificate For Waiver And Release Of Florida Estate Tax Lien Page 3

ADVERTISEMENT

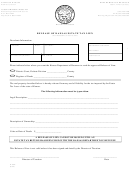

DR-308

Request and Certificate for Waiver and

R. 10/09

Release of Florida Estate Tax Lien

Page 3

Value of Estate

Name of decedent

Social Security Number (SSN)*

Date of death

Value of property to be released ........................................................................... $ __________________________________________

Value of remaining real property in Florida if release is issued ............................. $ __________________________________________

Value of all other property having tax situs in Florida ........................................... $ __________________________________________

Total gross value of decedent’s estate .................................................................. $ __________________________________________

Estimated taxable estate for federal estate tax purposes .................................... $ __________________________________________

I, the undersigned,____________________________________________, do hereby state under penalties of perjury that I have read

(Print name of personal representative)

this document and the information stated in it is true [ss. 92.525(1)(b); 213.37; 837.06, F.S.].

Signature _________________________________________________

Date ____________________________________________________

(Personal representative or attorney for estate)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4