Instructions For Form W-8exp

ADVERTISEMENT

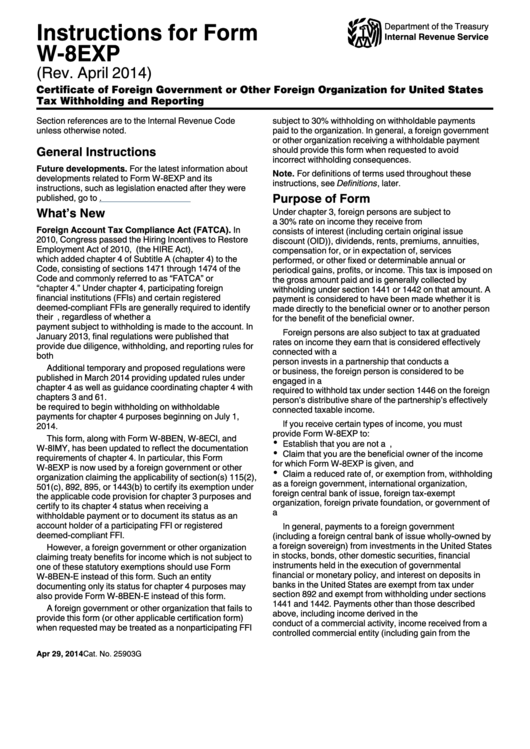

Instructions for Form

Department of the Treasury

Internal Revenue Service

W-8EXP

(Rev. April 2014)

Certificate of Foreign Government or Other Foreign Organization for United States

Tax Withholding and Reporting

Section references are to the Internal Revenue Code

subject to 30% withholding on withholdable payments

unless otherwise noted.

paid to the organization. In general, a foreign government

or other organization receiving a withholdable payment

General Instructions

should provide this form when requested to avoid

incorrect withholding consequences.

Future developments. For the latest information about

Note. For definitions of terms used throughout these

developments related to Form W-8EXP and its

instructions, see Definitions, later.

instructions, such as legislation enacted after they were

Purpose of Form

published, go to

What’s New

Under chapter 3, foreign persons are subject to U.S. tax at

a 30% rate on income they receive from U.S. sources that

Foreign Account Tax Compliance Act (FATCA). In

consists of interest (including certain original issue

2010, Congress passed the Hiring Incentives to Restore

discount (OID)), dividends, rents, premiums, annuities,

Employment Act of 2010, P.L. 111-147 (the HIRE Act),

compensation for, or in expectation of, services

which added chapter 4 of Subtitle A (chapter 4) to the

performed, or other fixed or determinable annual or

Code, consisting of sections 1471 through 1474 of the

periodical gains, profits, or income. This tax is imposed on

Code and commonly referred to as “FATCA” or

the gross amount paid and is generally collected by

“chapter 4.” Under chapter 4, participating foreign

withholding under section 1441 or 1442 on that amount. A

financial institutions (FFIs) and certain registered

payment is considered to have been made whether it is

deemed-compliant FFIs are generally required to identify

made directly to the beneficial owner or to another person

their U.S. account holders, regardless of whether a

for the benefit of the beneficial owner.

payment subject to withholding is made to the account. In

Foreign persons are also subject to tax at graduated

January 2013, final regulations were published that

rates on income they earn that is considered effectively

provide due diligence, withholding, and reporting rules for

connected with a U.S. trade or business. If a foreign

both U.S. withholding agents and FFIs under chapter 4.

person invests in a partnership that conducts a U.S. trade

Additional temporary and proposed regulations were

or business, the foreign person is considered to be

published in March 2014 providing updated rules under

engaged in a U.S. trade or business. The partnership is

chapter 4 as well as guidance coordinating chapter 4 with

required to withhold tax under section 1446 on the foreign

chapters 3 and 61. U.S. withholding agents and FFIs will

person’s distributive share of the partnership’s effectively

be required to begin withholding on withholdable

connected taxable income.

payments for chapter 4 purposes beginning on July 1,

If you receive certain types of income, you must

2014.

provide Form W-8EXP to:

This form, along with Form W-8BEN, W-8ECI, and

Establish that you are not a U.S. person,

W-8IMY, has been updated to reflect the documentation

Claim that you are the beneficial owner of the income

requirements of chapter 4. In particular, this Form

for which Form W-8EXP is given, and

W-8EXP is now used by a foreign government or other

Claim a reduced rate of, or exemption from, withholding

organization claiming the applicability of section(s) 115(2),

as a foreign government, international organization,

501(c), 892, 895, or 1443(b) to certify its exemption under

foreign central bank of issue, foreign tax-exempt

the applicable code provision for chapter 3 purposes and

organization, foreign private foundation, or government of

certify to its chapter 4 status when receiving a

a U.S. possession.

withholdable payment or to document its status as an

account holder of a participating FFI or registered

In general, payments to a foreign government

deemed-compliant FFI.

(including a foreign central bank of issue wholly-owned by

a foreign sovereign) from investments in the United States

However, a foreign government or other organization

in stocks, bonds, other domestic securities, financial

claiming treaty benefits for income which is not subject to

instruments held in the execution of governmental

one of these statutory exemptions should use Form

financial or monetary policy, and interest on deposits in

W-8BEN-E instead of this form. Such an entity

banks in the United States are exempt from tax under

documenting only its status for chapter 4 purposes may

section 892 and exempt from withholding under sections

also provide Form W-8BEN-E instead of this form.

1441 and 1442. Payments other than those described

A foreign government or other organization that fails to

above, including income derived in the U.S. from the

provide this form (or other applicable certification form)

conduct of a commercial activity, income received from a

when requested may be treated as a nonparticipating FFI

controlled commercial entity (including gain from the

Apr 29, 2014

Cat. No. 25903G

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9