Independent Contractor Agreement For Writing Specialist

ADVERTISEMENT

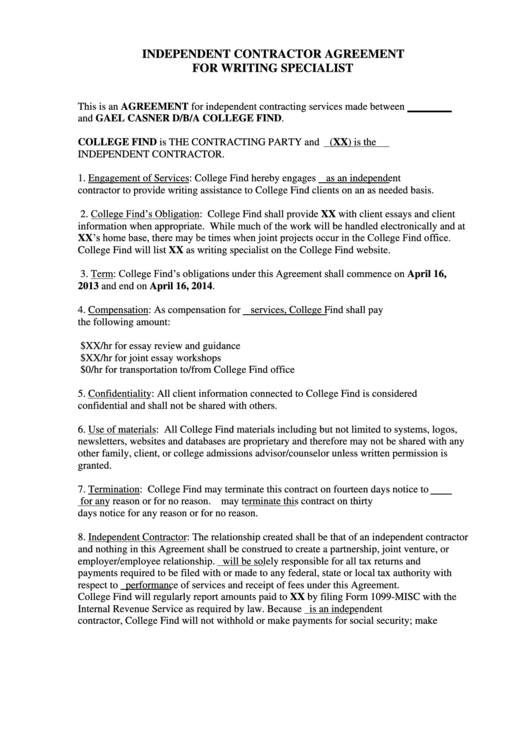

INDEPENDENT CONTRACTOR AGREEMENT

FOR WRITING SPECIALIST

This is an AGREEMENT for independent contracting services made between

and GAEL CASNER D/B/A COLLEGE FIND.

COLLEGE FIND is THE CONTRACTING PARTY and

(XX) is the

INDEPENDENT CONTRACTOR.

1. Engagement of Services: College Find hereby engages

as an independent

contractor to provide writing assistance to College Find clients on an as needed basis.

2. College Find’s Obligation: College Find shall provide XX with client essays and client

information when appropriate. While much of the work will be handled electronically and at

XX’s home base, there may be times when joint projects occur in the College Find office.

College Find will list XX as writing specialist on the College Find website.

3. Term: College Find’s obligations under this Agreement shall commence on April 16,

2013 and end on April 16, 2014.

4. Compensation: As compensation for

services, College Find shall pay

the following amount:

$XX/hr for essay review and guidance

$XX/hr for joint essay workshops

$0/hr for transportation to/from College Find office

5. Confidentiality: All client information connected to College Find is considered

confidential and shall not be shared with others.

6. Use of materials: All College Find materials including but not limited to systems, logos,

newsletters, websites and databases are proprietary and therefore may not be shared with any

other family, client, or college admissions advisor/counselor unless written permission is

granted.

7. Termination: College Find may terminate this contract on fourteen days notice to

for any reason or for no reason.

may terminate this contract on thirty

days notice for any reason or for no reason.

8. Independent Contractor: The relationship created shall be that of an independent contractor

and nothing in this Agreement shall be construed to create a partnership, joint venture, or

employer/employee relationship.

will be solely responsible for all tax returns and

payments required to be filed with or made to any federal, state or local tax authority with

respect to

performance of services and receipt of fees under this Agreement.

College Find will regularly report amounts paid to XX by filing Form 1099-MISC with the

Internal Revenue Service as required by law. Because

is an independent

contractor, College Find will not withhold or make payments for social security; make

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2