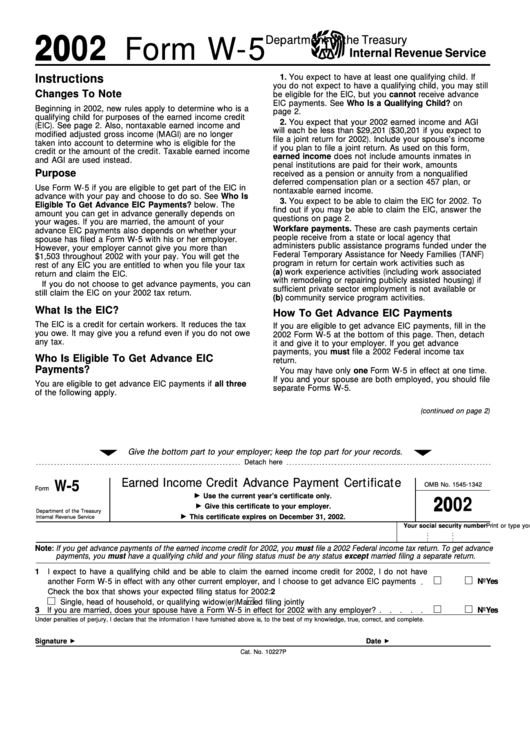

2002 Form W-5 - Department Of The Treasury Internal Revenue Service

ADVERTISEMENT

Department of the Treasury

2002

Form W-5

Internal Revenue Service

Instructions

1. You expect to have at least one qualifying child. If

you do not expect to have a qualifying child, you may still

Changes To Note

be eligible for the EIC, but you cannot receive advance

EIC payments. See Who Is a Qualifying Child? on

Beginning in 2002, new rules apply to determine who is a

page 2.

qualifying child for purposes of the earned income credit

2. You expect that your 2002 earned income and AGI

(EIC). See page 2. Also, nontaxable earned income and

will each be less than $29,201 ($30,201 if you expect to

modified adjusted gross income (MAGI) are no longer

file a joint return for 2002). Include your spouse’s income

taken into account to determine who is eligible for the

if you plan to file a joint return. As used on this form,

credit or the amount of the credit. Taxable earned income

earned income does not include amounts inmates in

and AGI are used instead.

penal institutions are paid for their work, amounts

Purpose

received as a pension or annuity from a nonqualified

deferred compensation plan or a section 457 plan, or

Use Form W-5 if you are eligible to get part of the EIC in

nontaxable earned income.

advance with your pay and choose to do so. See Who Is

3. You expect to be able to claim the EIC for 2002. To

Eligible To Get Advance EIC Payments? below. The

find out if you may be able to claim the EIC, answer the

amount you can get in advance generally depends on

questions on page 2.

your wages. If you are married, the amount of your

Workfare payments. These are cash payments certain

advance EIC payments also depends on whether your

people receive from a state or local agency that

spouse has filed a Form W-5 with his or her employer.

administers public assistance programs funded under the

However, your employer cannot give you more than

Federal Temporary Assistance for Needy Families (TANF)

$1,503 throughout 2002 with your pay. You will get the

program in return for certain work activities such as

rest of any EIC you are entitled to when you file your tax

(a) work experience activities (including work associated

return and claim the EIC.

with remodeling or repairing publicly assisted housing) if

If you do not choose to get advance payments, you can

sufficient private sector employment is not available or

still claim the EIC on your 2002 tax return.

(b) community service program activities.

What Is the EIC?

How To Get Advance EIC Payments

The EIC is a credit for certain workers. It reduces the tax

If you are eligible to get advance EIC payments, fill in the

you owe. It may give you a refund even if you do not owe

2002 Form W-5 at the bottom of this page. Then, detach

any tax.

it and give it to your employer. If you get advance

payments, you must file a 2002 Federal income tax

Who Is Eligible To Get Advance EIC

return.

Payments?

You may have only one Form W-5 in effect at one time.

If you and your spouse are both employed, you should file

You are eligible to get advance EIC payments if all three

separate Forms W-5.

of the following apply.

(continued on page 2)

Give the bottom part to your employer; keep the top part for your records.

Detach here

Earned Income Credit Advance Payment Certificate

W-5

OMB No. 1545-1342

Form

Use the current year’s certificate only.

2002

Give this certificate to your employer.

Department of the Treasury

This certificate expires on December 31, 2002.

Internal Revenue Service

Print or type your full name

Your social security number

Note: If you get advance payments of the earned income credit for 2002, you must file a 2002 Federal income tax return. To get advance

payments, you must have a qualifying child and your filing status must be any status except married filing a separate return.

1

I expect to have a qualifying child and be able to claim the earned income credit for 2002, I do not have

another Form W-5 in effect with any other current employer, and I choose to get advance EIC payments

Yes

No

2

Check the box that shows your expected filing status for 2002:

Single, head of household, or qualifying widow(er)

Married filing jointly

3 If you are married, does your spouse have a Form W-5 in effect for 2002 with any employer?

Yes

No

Under penalties of perjury, I declare that the information I have furnished above is, to the best of my knowledge, true, correct, and complete.

Signature

Date

Cat. No. 10227P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3