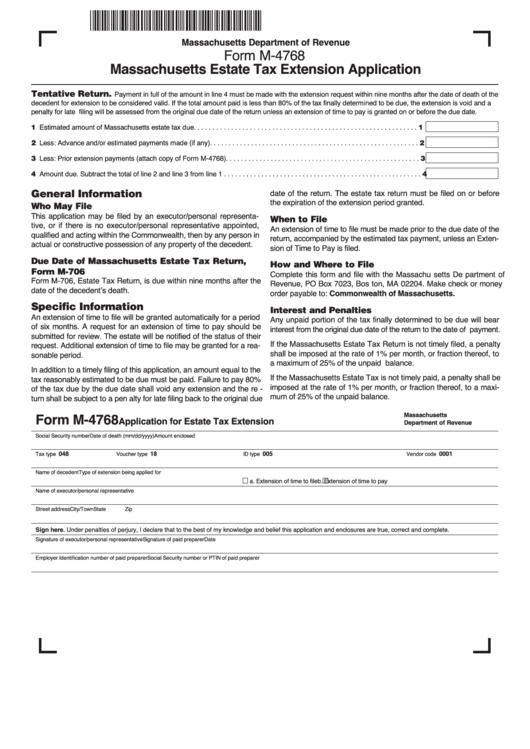

Form M-4768 - Massachusetts Estate Tax Extension Application

ADVERTISEMENT

Massachusetts Department of Revenue

Form M-4768

Massachusetts Estate Tax Extension Application

Tentative Return.

Payment in full of the amount in line 4 must be made with the extension request within nine months after the date of death of the

decedent for extension to be considered valid. If the total amount paid is less than 80% of the tax finally determined to be due, the extension is void and a

penalty for late filing will be assessed from the original due date of the return unless an extension of time to pay is granted on or before the due date.

1 Estimated amount of Massachusetts estate tax due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Less: Advance and/or estimated payments made (if any) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Less: Prior extension payments (attach copy of Form M-4768) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Amount due. Subtract the total of line 2 and line 3 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

General Information

date of the return. The estate tax return must be filed on or before

the expiration of the extension period granted.

Who May File

This application may be filed by an executor/personal representa-

When to File

tive, or if there is no executor/personal representative appointed,

An extension of time to file must be made prior to the due date of the

qualified and acting within the Commonwealth, then by any person in

return, accompanied by the estimated tax payment, unless an Exten-

actual or constructive possession of any property of the decedent.

sion of Time to Pay is filed.

Due Date of Massachusetts Estate Tax Return,

How and Where to File

Form M-706

Complete this form and file with the Massachu setts De partment of

Form M-706, Estate Tax Return, is due within nine months after the

Revenue, PO Box 7023, Bos ton, MA 02204. Make check or money

date of the decedent’s death.

order payable to: Commonwealth of Massachusetts.

Specific Information

Interest and Penalties

An extension of time to file will be granted automatically for a period

Any unpaid portion of the tax finally determined to be due will bear

of six months. A request for an extension of time to pay should be

interest from the original due date of the return to the date of payment.

submitted for review. The estate will be notified of the status of their

If the Massachusetts Estate Tax Return is not timely filed, a penalty

request. Additional extension of time to file may be granted for a rea-

shall be imposed at the rate of 1% per month, or fraction thereof, to

sonable period.

a maximum of 25% of the unpaid balance.

In addition to a timely filing of this application, an amount equal to the

If the Massachusetts Estate Tax is not timely paid, a penalty shall be

tax reasonably estimated to be due must be paid. Failure to pay 80%

imposed at the rate of 1% per month, or fraction thereof, to a maxi-

of the tax due by the due date shall void any extension and the re -

mum of 25% of the unpaid balance.

turn shall be subject to a pen alty for late filing back to the original due

Massachusetts

Form M-4768

Application for Estate Tax Extension

Department of Revenue

Social Security number

Date of death (mm/dd/yyyy)

Amount enclosed

048

18

005

0001

Tax type

Voucher type

ID type

Vendor code

Name of decedent

Type of extension being applied for

a. Extension of time to file

b. Extension of time to pay

Name of executor/personal representative

Street address

City/Town

State

Zip

Sign here. Under penalties of perjury, I declare that to the best of my knowledge and belief this application and enclosures are true, correct and complete.

Signature of executor/personal representative

Signature of paid preparer

Date

Employer Identification number of paid preparer

Social Security number or PTIN of paid preparer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1